Cost of Capital represents the opportunity cost of all financial capital, primarily debt and equity, invested in an enterprise. ‘Opportunity cost’ also referred to as ‘hurdle cost’ or ‘discount rate’, is of primary importance in valuation and helps investors in arriving at the correct price of a company’s stock. Given the importance of this metric in creating value for shareholders, it is essential to compare the cost of capital for the GCC countries over the years.

Key Points to be noted

- Cost of Capital depends on the risk free rate (RFR) of the country. The RFR is usually taken as the yield of 10-year treasury bonds issued by the particular country.

- Cost of Capital also depends on the equity risk premium (ERP) which is the premium expected by the market for investing in equities since equities are riskier than bonds.

- COVID-19 has resulted in risk free rates coming down and equity risk premiums going up as investors eschew risk and seek the safety of government bonds.

Weighted Average Cost of Capital in the GCC over the years

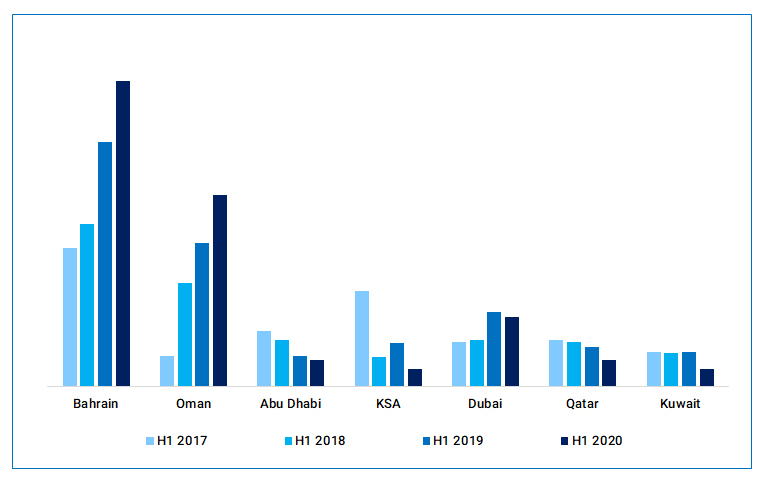

The progression of the WACC for GCC countries from H1 2017 to H1 2020 is shown in the exhibit below.

Exhibit 1: GCC WACC, H1 2017 to H1 2020

Source: Marmore Research; WACC is the average of the three methods explained later in the article

Ad: Marmore Research Report

Since H1 2017, the WACC has witnessed a decline for Saudi Arabia, Abu Dhabi, Qatar and Kuwait with the WACC for H1 2020 being the lowest. The opposite trend is observed for Bahrain and Oman with WACC continuously increasing each year. Both countries had been affected by low oil prices since 2014 and COVID-19 has worsened the situation. The WACC for Dubai while seeing a mild decline in H1 2020 has been within a tight range for the past four years.

Equity Risk Premium

The easy way to calculate ERP is to find the difference between historic long-term return of equity index and the risk-free investment, such as government bonds. However, this methodology has its drawbacks especially for emerging and frontier countries like the GCC region. Due to this we use alternative methods like Sovereign rating, CDS Spreads and Implied ERP to estimate the ERP for GCC countries.

For Sovereign rating method, the ERP of GCC countries are arrived at by adding the U.S market’s equity risk premium (ERP) of 6.01% and the default spread based on their credit rating. In the CDS Spreads method, the ERP is obtained by adding the CDS spread of a country’s bond to the US ERP of 6.01%. In the Implied equity risk premium approach we assume that stocks are correctly priced and by estimating the internal rate of return (IRR) and subtracting out the risk free rate from IRR should yield an implied equity risk premium.

Did You Know?Learn More

- Kuwait has the highest reserves among GCC countries, relative to its GDP at 542%.

- Saudi Arabia is expected to enjoy the highest credit growth at 5.3% in 2020.

- UAE could continue to enjoy surplus trade position in 2020.

The average ERP for all GCC countries had increased in H1 2020 from that of H1 2019 mainly due to a higher implied ERP on account of lowered GDP growth estimates leading to a fall in stock index values in all GCC countries since the outbreak of COVID-19 in January. Also, the increase in US ERP from 5.3% in 2019 to 6.01% in 2020 contributed to the increase. The increase in ERP has been much higher for Bahrain and Oman due to successive downgrades increasing the ERP calculated through the Ratings method and CDS Spreads methods also.

WACC computed using the three methods (H1 2020)

For GCC countries except for Bahrain and Oman, the WACC for H1 2020 decreased due to fall in risk free rate (RFR)as a result of monetary easing and their credit ratings remaining unchanged. The decrease in the RFR was more than the increase in the ERP for those countries. Oman and Bahrain, due to credit rating downgrades saw high risk free rates of 6.7% and 5.5% which failed to compensate for the increase in ERP and consequently the WACC increased for them.

Conclusion

The COVID-19 crisis has negatively impacted GCC countries with fiscal woes like Bahrain and Oman with their cost of capital increasing since the outbreak. The other GCC Countries, with investment-grade credit ratings, have seen their risk free rate decrease, which has reduced the weighted average cost of capital in those countries, despite the fall in equity markets in H1 2020 increasing the equity risk premium. The gradual relaxation of lockdown restrictions and loose monetary policies have seen equity markets worldwide making a sustained recovery in Q3 2020 and the GCC stock markets were no exception. Currently (as on October 7), Saudi Arabia’s Tadawul Index is down only 0.4% YTD. This stock market recovery would result in reduction of the implied ERP. However, the Cost of capital in H1 2021 for GCC would depend on the extent of the wider economic recovery in terms of GDP growth, control of the COVID-19 pandemic, and the equity markets continuing their recovery.

To buy the full detailed report, please click here.

Ad: Marmore Research Report

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More