Executive Summary

What is this report about?

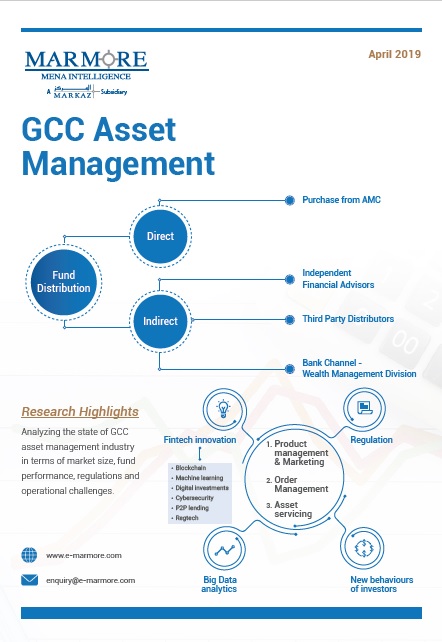

GCC Asset managementreport provides analysis on the Assets under Management in the region and where it stands compared to the developed nations. The report primarily focuses on mutual fund assets under management; highlights the features and characteristics of the regional industry ranging from assets under different categories, number of funds, and cost in terms of management fees. The report also discusses the challenges for the industry and suggests solutions to overcome the same. Key focus areas that could help in garnering additional assets, which could contribute to the growth of the industry is also dealt.

Who will benefit and why?

The report sheds insights into the regional asset management industry, specifically about the fund management. Players in the asset management industry such as regulatory bodies, fund managers, financial institutions, institutional investors, HNWIs and retail investors amongst others would find the report beneficial. This report would aid in understanding the industry concentration, explores the depth of mutual funds in the region, and establishes the key industry participants.

How exhaustive is this report?

The report has analyzed the asset management industry in terms of industry architecture, market segments, and cost structure. Recent events such as the inclusion into EM Indices and its impact on the industry has also been covered. Impact of technological advancements such as fintech, adoption of robo-advisories, and rise of ETFs have been covered. The report also includes detailed analysis of mutual funds across GCC countries.

Also Read: "GCC Asset Management Industry - 2022"

Key Questions Addressed

- Where doesGCC Asset managementindustry stand compared to developed nations?

- How much assets do the regional fund managers manage in the region?

- How would the inclusion of countries into benchmark EM indices impact the mutual fund industry?

- What could be done to garner assets?

- What are the key challenges and growth opportunities in the region?

Table of Contents

- Executive Summary

- Mutual Fund Industry Worldwide and what it portends for GCC

- Industry Architecture

- Market Segment

- Asset under Management Analysis

- Impact of Index Inclusion

- Challenges to the Industry

- Key questions inGCC Asset ManagementIndustry that must be addressed

- Appendix