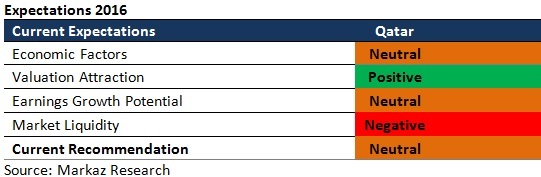

Growth in Qatar is expected to be moderate (4.9% Real GDP growth for 2016) on account of calculated spending cuts. Qatar, in its recent budget has announced to reduce the budget spending by 7.28% to $ 55 Bn. Major infrastructure spending has been left untouched with the spending cuts expected to affect in the excess in state-funded organizations such as Qatar Museums, Qatar Foundation and Al Jazeera. Stock turnover ratio stood at 13% in 2015 as value traded for the year fell by 56% to USD 23bn from USD 41bn registered a year back. Qatar has a long way to go to reach KSA’s turnover levels of 93%. 2014 being the year of Qatar’s inclusion in MSCI Emerging Market Index witnessed hectic investor activity. Consequently, the fall in value traded could be a result of foreign investment cap for stocks being already met and no further scope for fresh investments.

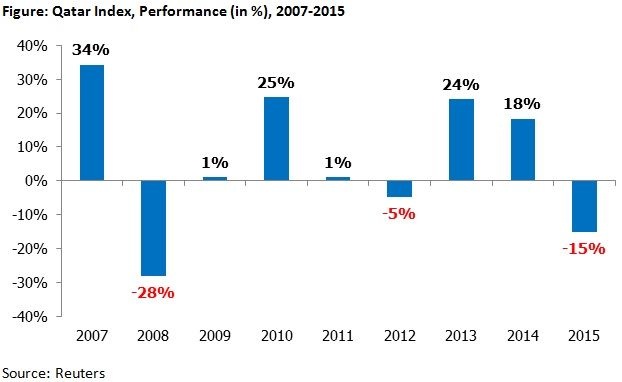

Qatar index, which was majorly flat until June 2015, started declining in the latter half of the year. GCC markets were rocked by the fall in Chinese equities which resulted in region wide selling. Uncertainty over oil prices and political situation in the region only helped to exacerbate the problem. Qatar market fell sharply in November 2015; Qatar lost -13.0%.

Valuation: Positive

According to Qatar’s stock market outlook for 2016, On a standalone P/E basis, Qatar, with a ratio of 11.1x of the earnings, appears to trade at lower valuation level compared to peers such as KSA & Kuwait. On P/B basis Qatar market is the most expensive among all GCC nations at 1.6x. Dividend yield for Qatar stands at 5.1% which is the highest among GCC along with Bahrain. On an overall basis, we adopt a positive view on Qatar.

Corporate Earnings: Negative

At the start of 2016, we expect overall earnings growth to be marginally negative at -0.6%. While Qatar has been diversifying its source of revenues, the payoff from them is not expected to be immediate. Banks and construction related sectors alone are expected to post positive earnings in 2016, the former owing to the strong local consumption demand and credit growth, the latter owing to the huge infrastructure spending that the Qatar government has been undertaking in its preparation for the Football World Cup in 2022.On a overall level we expect the earnings growth to be subdued in 2016 and hence hold a neutral view.

Economy: Neutral

Real GDP growth in Qatar is expected to be only slightly better in 2016, on the back of increased infrastructure spending that the government has planned as part of its bid for the 2022 Football World Cup. Qatar has earmarked a total of $229 Bn to be spent on the projects, which includes construction of a new city, a rail network and a mega reservoirs project.

Market Liquidity: Negative

Global factors were also not favorable during 2015 resulting in a wide-spread sell-off in the region post the Chinese stock market crash in June. MSCI upgraded Qatar to emerging market last year and it was also included in the MSCI emerging market index last year. Unfortunately this upgrade alone has not been sufficient enough to increase the turnover in the Qatar market.

Concluding Remarks

At the start of 2016, we expect overall earnings growth to be marginally negative at -0.6%. While Qatar has been diversifying its source of revenues, the payoff from them is not expected to be immediate. On a standalone P/E basis, Qatar, with a ratio of 11.1x of the earnings, appears to trade at lower valuation level compared to peers such as KSA & Kuwait. On P/B basis Qatar market is the most expensive among all GCC nations at 1.6x. Dividend yield for Qatar stands at 5.1% which is the highest among GCC along with Bahrain. On an overall basis, we adopt a neutral view on Qatar.

The initial euphoria surrounding the inclusion at the beginning of 2015 faded away as poor investor sentiment coupled with the drop in oil price, regional instability and turmoil in Chinese equities forced international investors to review their strategies. We expect 2016 to be much better on account of the positive steps taken by the Qatar stock exchange on issues such as stock lending and short selling.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More