With a total market capitalization of USD 8.3 trillion, the MSCI Emerging Markets (EM) Index has emerged as one of the most important global indices tracked by many ETFs and mutual funds. Inclusion in the index has become sought after not only due to the potential inflows from overseas funds, but also the credibility it gives to the included country’s capital markets.

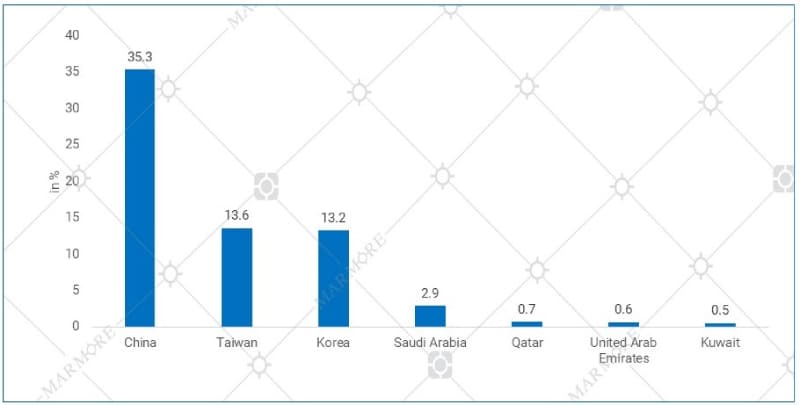

Weightage of GCC nations in the MSCI EM index is quite low

Among the GCC, companies from UAE and Qatar were included in the index in 2014 while Saudi and Kuwaiti companies were included in 2019 and 2020. Saudi Arabia enjoys the highest weightage in the index at 2.8% with 36 companies, followed by Qatar at 0.67% with 12 companies, UAE at 0.59% with 9 companies and Kuwait at 0.52% with 6 companies respectively. However, the weightage allotted to the GCC is quite low in comparison to that of countries like China (35%), Taiwan (13.2%), South Korea (13.1%) and India (10.2%).

Weights of GCC nations in MSCI EM Index

Note: Weights based on iShares MSCI EM ETF

Note: Weights based on iShares MSCI EM ETF

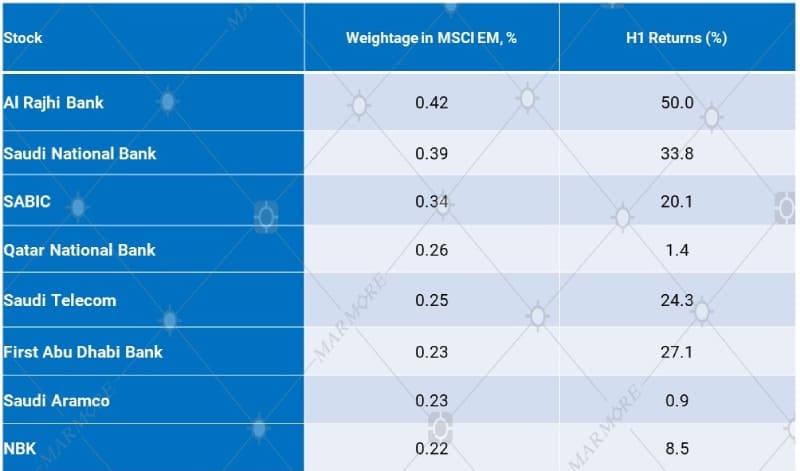

Banking Sector dominates GCC representation in the MSCI EM index

At the company level, the GCC constituents with the most weightage is in the banking sector. Saudi Arabia’s Al-Rajhi Bank ranks highest with a weightage at 0.42%, followed by Saudi National Bank (erstwhile NCB) at 0.39%. Meanwhile, Saudi Aramco, one of the largest companies in the world with market cap of USD 1.9 trillion, has a relatively low weightage of 0.23%. An important reason could be the comparatively low free-float market cap of Aramco of USD 124 billion and fewer number of shares being available for trading on the exchanges.

MSCI Emerging Markets Index – Top GCC stocks by weightage

Source: Refinitiv; Note: Weights based on iShares MSCI EM ETF

Source: Refinitiv; Note: Weights based on iShares MSCI EM ETF

Energy Sector has low weightage in the MSCI EM index

Other reasons for low representation of GCC companies particularly in the Energy sector is that many of them are majority owned by the governments and as in the case of Aramco, a major source of revenue for the government which may not always be in the best interest of minority shareholders like international funds.

Also, with the emergence of ESG investing, the Energy sector is itself seeing diminished interest from global fund managers with the EMSCI EM index allocating only 5.3% to the sector while the tech sector leads with 36%. Poor representation of GCC companies in the tech sector is another reason for the GCC lagging behind other emerging markets in the MSCI EM index.

The article is an excerpt from our “Global & GCC Capital Markets Review: June 2021” report. Read more

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More