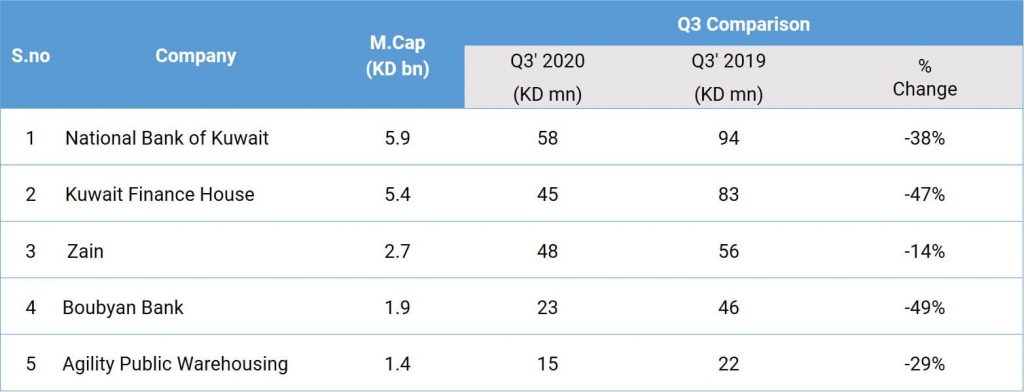

Kuwait Earnings

November saw a number of blue chip companies in Kuwait and GCC declare their financial results for the third quarter (Q3) of 2020. The earnings of Kuwaiti blue chip companies saw a decrease in Q3-2020 compared to that of the same period in 2019 as seen from the exhibit below.

Exhibit 1: Q3 earnings of top 5 Kuwaiti companies by Market Capitalisation

Source: Boursa Kuwait; Reuters; Data as of November 29, 2020

Commentary:

National Bank of Kuwait: Net Profit fell year on year(y-o-y) due to higher loan loss provisioning(LLP) which doubled to KD 81 million in Q3-2020.

Kuwait Finance House: Net Profit fell y-o-y due to higher LLP which increased to KD 59.7 million in Q3-2020 from KD 45 million in Q3-2019.

Zain: Q3-2020 net profits fell y-o-y due to decrease in revenue by 5% y-o-y as a result of the pandemic. However, expenses remained flat leading to the fall in net profits.

Boubyan Bank: Net Profits fell y-o-y due to higher LLP which increased to KD 46 million in Q3-2020 from KD 18 million in Q3-2019.

Agility Public Warehousing: Net Profit fell y-o-y due to 9% decrease in total revenues while expenses fell by a smaller amount. The Infrastructure segment saw a fall in revenues by 12% to KD 292 million in Q3-2020 due to COVID-19 impact.

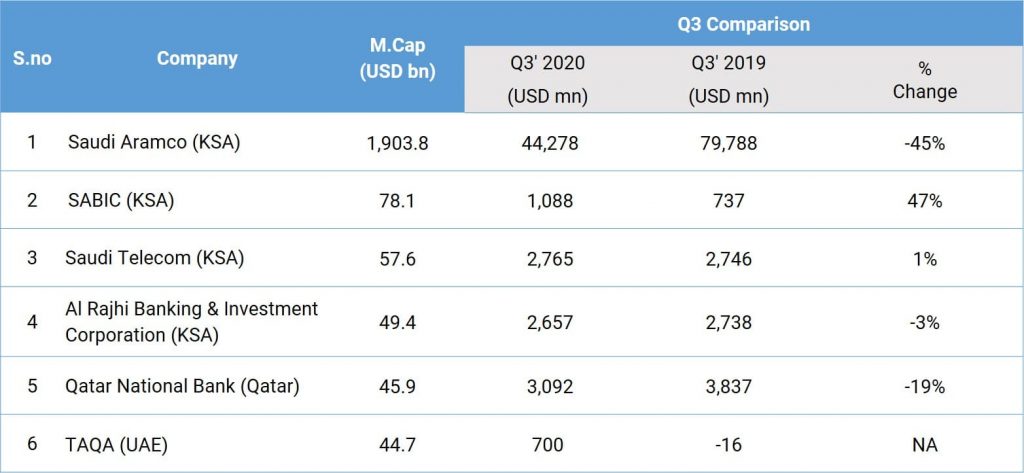

GCC Blue Chip Earnings

Some of the GCC Blue chips reported strong results in Q3. Out of the top 6 GCC companies with the largest market capitalisation, three of them reported increases in y-o-y profits in Q3-2020 over Q3-2019 while three reported decreases.

Exhibit 2: Q3 earnings of top 6 GCC companies by Market Capitalisation

Source: Tadawul, Reuters; Data as of November 29, 2020

Commentary:

Saudi Aramco (KSA): Q3-2020 net profits fell due to lower oil prices in Q3-2020 compared to that of 2019. However, they were nearly double that of Q2-2020 as the global economies recover from the COVID-19 crisis.

SABIC (KSA): Net profits were 47% higher than the year ago period due to revenues increasing by 19% due to a reversal of impairment provisions in certain financial assets in the quarter of about USD 184 million. The company had declared losses in the three previous quarters due to COVID-19 hit and oversupply in the petrochemicals space.

Saudi Telecom (KSA): Net profits increased y-o-y due to revenue increasing by 5.4% while cost of revenues decreased by 4.5%.

Al Rajhi Banking & Investment Corporation (KSA): Net profits decreased slightly y-o-y due to a 39.9% increase in credit impairment charges to USD 124 million.

Qatar National Bank (Qatar): Net profits decreased since LLP increased to USD 520 million in Q3-2020 against USD 160 million last year.The article is an excerpt from our “Global & GCC Capital Markets Review: November 2020” report. Read more

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More