Liquidity is one of the key indicators of a stock market and is a fundamental requirement for market efficiency. In recent years, Saudi Arabia’s equity market has implemented reforms, such as relaxation of foreign ownership and has achieved milestones such as inclusion in key indices including the MSCI Emerging Market Indices. With the listing of Saudi Aramco, it has also become one of the top 10 markets globally, by market capitalization. Given the market’s importance in GCC and globally, the impact of COVID-19 on its liquidity has been analysed in this article.

With the economy still reeling under the impact of COVID-19, the equities market has continued to rally from their March 2020 lows. While the Tadawul Index had fallen by about 29% year-to-date in March, it was up by 21.2% on 30th of June, supported by stimulus measures and easing of lockdowns.

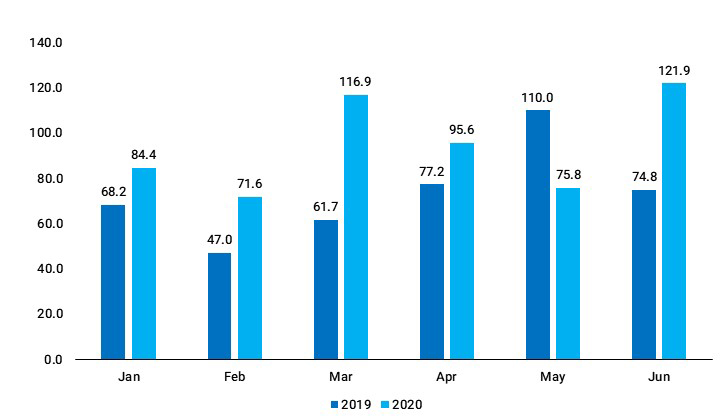

During periods of stability, the liquidity remains fairly constant. During times of stress, the stock market could either be characterised by high or low liquidity(IMF). Under the impact of COVID-19, since March, liquidity both in terms of value traded and turnover ratio has increased year on year, except for May. The decline in liquidity in May could be due to the austerity measures such as tripling of VAT and suspension of cost of living allowance announced during the month.

Figure: Value Traded in Saudi Tadawul 2019 vs 2020 (Jan-June) (SAR billion)

Source: Refinitiv; June 2020 Value adjusted for Aramco- SABIC equity deal.

Source: Refinitiv; June 2020 Value adjusted for Aramco- SABIC equity deal.

Did You Know? Saudi Arabia is expected to enjoy the highest credit growth at 5.3% in 2020 - Learn more

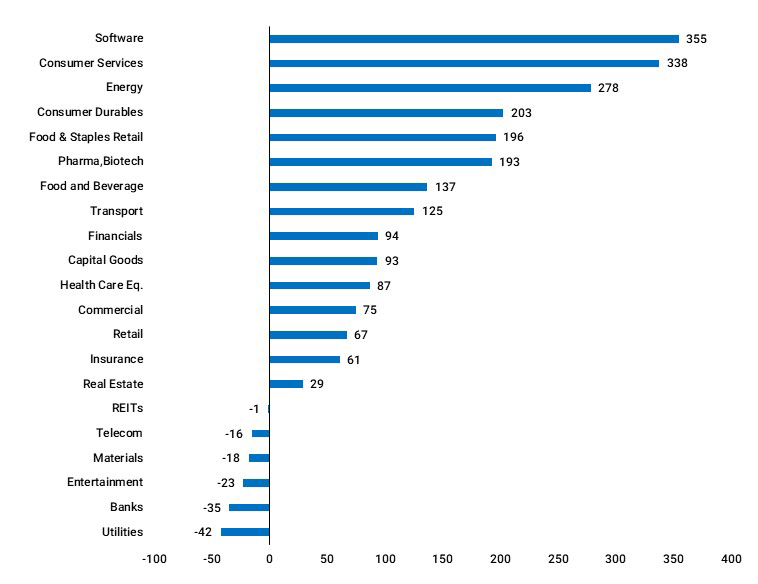

Fiscal and monetary stimulus measures to improve liquidity in the economy could have contributed to the increased liquidity in the stock market. The decline in yields in bond markets might have also caused equities to be in favour, spurring ‘buy-at-lows’ sentiment among investors. The increase in liquidity is driven mostly by retail participation. Liquidity, in terms of value traded, in sectors such as software services, energy, consumer services and consumer durables have increased year-on-year during Apr-Jun 2020. Sectors such as banks, media and entertainment and utilities have seen decline in liquidity.

Figure: Change in Value Traded across Sectors 2019 vs 2020 (April –June) (%)

Source: Saudi Stock Exchange; Marmore Research

Source: Saudi Stock Exchange; Marmore Research

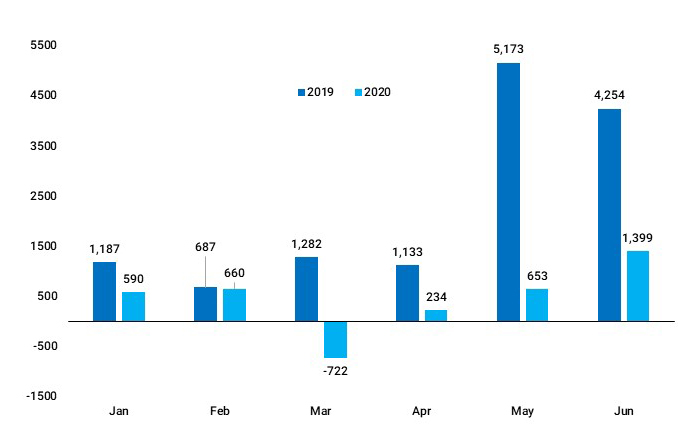

Foreign flows have dropped in 2020 compared to 2019. It could be due to base effect of higher inflows in around mid-2019 as Saudi Arabia was included in the MSCI Emerging Market Indices in May 2019. The onset of COVID-19 and the fall in oil prices due to disagreement between Saudi Arabia and Russia on OPEC+ deal had caused a fund outflow of USD 700 mn in March 2020. However, with buoyancy back in markets on the back of stimulus measures and with easing of lockdowns and OPEC+ production cuts supporting oil prices, foreign flows have recovered.

Figure: Foreign Capital Flows in Saudi Equity Market 2019 vs 2020 (Jan-June) (USD million)

Source: IIF

Source: IIF

According to the Saudi Capital Market Authority, the first half of 2020 has seen a year-on-year increase of 25% in number of IPO requests, a 50% increase in the requests for flotation for a market growth and 200% rise in capital increase requests for listed companies, compared to the first half of 2019. Despite COVID-19’s negative impact on the real economy and uncertainty over the recovery, the equity market has recovered from March lows and is showing an increasing trend in liquidity. The sustainability of the trend is in question as risks such as a slower recovery, a second wave of COVID-19, persist. However, if the trend does continue, liquidity is likely to sustain at reasonable levels.

Ad: Marmore Research Report

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More