Weighted Average Cost of Capital (WACC) assumes importance in corporate finance decision making. In the GCC, unlisted companies outnumber listed companies by miles and hence most of the deals involve unlisted companies in one way or other. Corporate finance professionals face twin problem while valuing an unlisted company. They have to estimate future cash flows and also estimate the appropriate “discount rate” at which these cash flows can be discounted to the present. Such a discount rate is nothing but the cost of capital adjusted for the weights of capital in the capital structure.

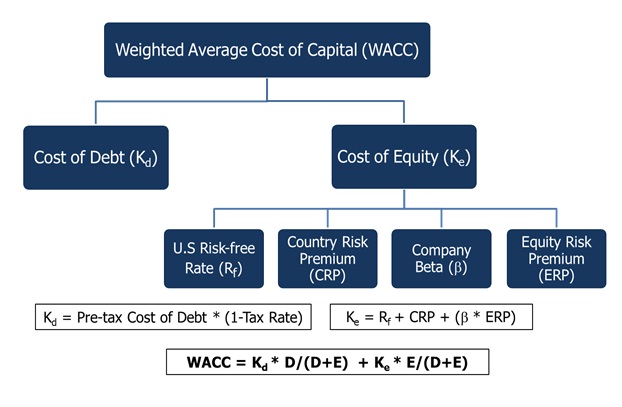

The broad methodology of our computation can be illustrated as:

Source: Markaz Research; Note: ‘D’ stands for Debt and ‘E’ stands for Equity.

In our report (GCC WACC – A Toolkit for Corporate Financiers), we have computed the WACC for GCC countries.

Why does WACC vary widely?

Cost of equity is subjective as different people use different methods to compute beta. Some use monthly data for past 5 years while others prefer weekly data for past 3 years. As beta is derived based on historical price data, few adjust it under the assumption that the beta value would revert towards the mean value of 1 over the long period. Difference in equity cost would lead to a range of values for cost of capital.

Risk-free rate and equity risk premium values are dynamic in nature and change with time depending on the market perception of risk. Read more

WACC Methodology

'Opportunity cost' also referred to as ‘hurdle cost’ or ‘discount rate’ is of primary importance in valuation and helps the management in identifying projects which add value to the enterprise. Given the importance of this metric in creating value for shareholders, it’ is essential to understand how it is computed. Though, in reality, it’s surprising to note that not much effort is diverted towards the calculation of cost of capital; while a significant amount of time is focussed on forecasting uncertain future cash flows. Improper capital cost assumptions could lead to type-I error (accepting projects that don’t add shareholder value) or type-II error (rejecting projects that add shareholder value).

In order to compute the cost of capital, we start by finding the cost of each capital component that the firm utilizes. Cost of capital primarily consists of equity and debt costs, weighed according to the proportions of debt and equity capital in the capital structure. The cost of debt can be inferred easily as it entails specific cost in the form of interest payments made in cash. The entire debt mix including money market debt in the form of commercial papers/notes, bank debt in the form of loans/overdraft, financial leases and bonds raised is aggregated. The interest payments made as a proportion of interest bearing debt instruments provides us with the debt cost.

Unlike debt holders, equity holders do not demand an explicit return on their capital. However, equity holders incur an implicit opportunity cost for investing in a specific company, because they could invest in an alternative company with similar risk profile. Equity cost involves various factors such as risk free asset, beta, market risk premium, country risk premium among others. Beta – a measure of priced risk, which is arrived by regressing the past price returns on an index. As private firms do not trade, estimation of beta becomes problematic for private firms.

For further reading on calculation of WACC for private companies in the GCC, click here.

'Register now' for Upcoming webinar on “GCC WACC – A Toolkit for Corporate Financiers” on Wednesday, 16th September 2015, 09:00 GMT [Check Time Zone]

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More