Exchange Traded Funds (ETF) was first introduced in the year 1993 and since then, it has made a long journey and won the interest and participation of many retail and institutional investors. Currently, there are more than 7,000 ETFs traded globally. The global ETF assets were worth about USD 7 trillion as of august 2020 (https://etfgi.com/news/press-releases/2020/09/etfgi-reports-assets-invested-etfs-and-etps-listed-globally-broke). Today ETFs are available in many countries, based on pure equity or a mix of equity and debt or fixed income instruments or alternative asset classes like commodities. ETFs are a powerful tool for investors not only to diversify their portfolios but also to construct customized portfolios that differ in the mix of assets (portfolio allocation) which the investors might think is best for them based on their own perception and assessment of risks and returns of different asset classes or sub-asset classes.

ETFs are passively managed funds that mimic the aggregate market index or any sub-indexes in each stock market or mimic a composite of indexes across several asset classes, all of which being possible with ease in execution and accompanied by low cost or expense ratio. Mutual funds and Fund of Funds (pooled funds invested in other funds) also allow investors to diversify their portfolios. But compared to mutual funds, ETFs provide more standardized building blocks for constructing customized portfolios and that too at a much lower cost compared to MFs. Unlike mutual funds, ETFs are passively managed and the ratio of asset managers cost to total expense is minimal. Standardization in ETFs leads to cost savings. Again, MFs are not traded in the stock exchange while ETFs are actively traded in the stock exchange providing real-time liquidity and price information to the investors that a MF cannot provide. Short trading and Future & Option trading can also be made available for ETFs, unlike MFs. Taking full advantage of ETFs requires investors to not only understand portfolio diversification but also optimal portfolio construction through asset allocation principles.

But why have ETFs not taken off in GCC markets? There are only 7 ETFs domiciled in Saudi Arabia since 2010 and two ETFs domiciled in Qatar launched since 2018. The aggregate ETF fund value domiciled in Saudi is only around USD 566 million while that of Qatar stands at approx. USD 267 million.

Table: ETFs domiciled within GCC region

Source: Refinitv; Saudi Stock Exchange

Source: Refinitv; Saudi Stock Exchange

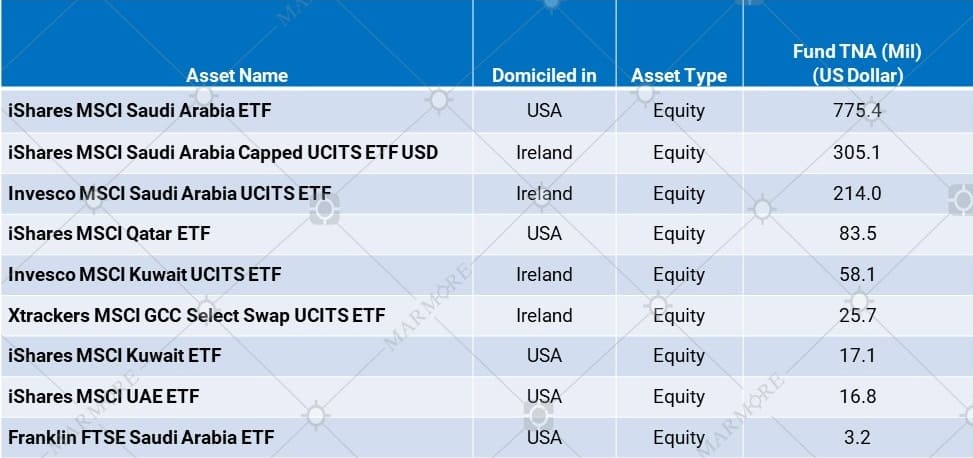

Interestingly, iShares MSCI Saudi Arabia ETF that was started in 2015 and domiciled in the USA commands a net asset value of USD 775 million. Additionally, Blackrock Fund manager of iShares) has four more funds focused in Kuwait, Saudi Arabia, Qatar and UAE and whose net assets aggregate USD 1,197 million. Invesco, Franklin Templeton and Xtrackers also have GCC country focused ETFs but comparatively their asset sizes are smaller. To capitalize on surging international investor interest following their upgrade into Emerging Market (EM) indices, USA domiciled funds focused in UAE and Qatar was incepted after 2014.

Table: ETFs domiciled outside GCC region

Source: Refinitv

Source: Refinitv

The number of ETFs based on GCC assets, including those domiciled in the USA are abysmally low. The low asset size of ETFs domiciled in Saudi Arabia compared with ETFs domiciled outside Saudi markets shows the lack of interest for the funds. The awareness about the ETFs and the participation from retail investors are very low compared to other developed and emerging markets.

For the situation to improve, increasing the awareness through investor education and enhanced investor participation in capital markets seem to be the need of the hour. It is disappointing to note that GCC equity markets with a combined market capitalization of USD 2,579 billion have total ETFs of only USD 0.8 billion. No doubt, the 2018 ETFs issuances in Qatar are however encouraging as they show greater investor interest in ETFs and this might signal a turning point for ETFs in the entire GCC.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More