Need an equity market framework

It is a classic mistake that all of us can be guilty of at some point in time. Mistaking historical stock market returns as a good proxy for future returns. While optimism breeds optimism, pessimism breeds pessimism. If we have a great decade (like how S&P 500 is), it will be nearly impossible to be utterly pessimistic and vice versa. Time and again it has been proved that history never repeats but rhymes. However, intuitively it is the “repeat” storyline (be it optimistic or pessimistic) that is constantly played to the gallery to the detriment of client interest.

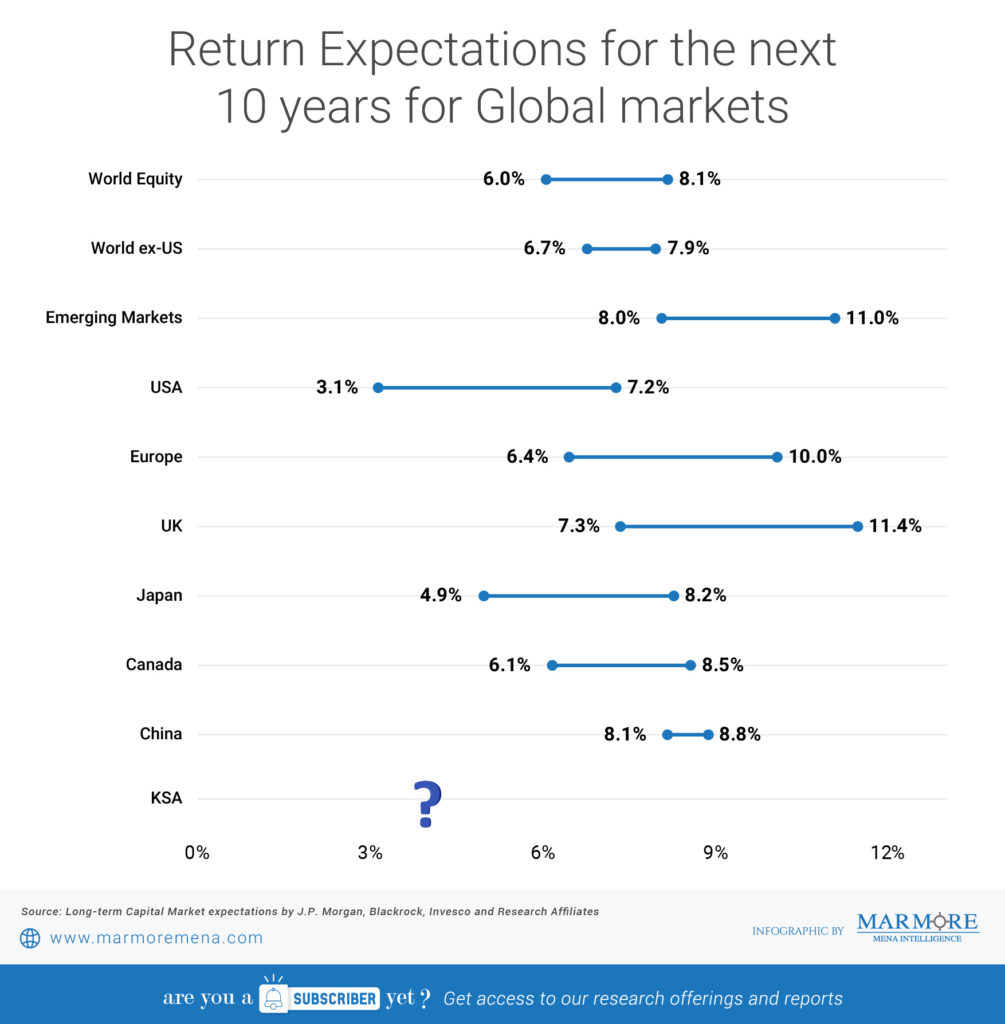

While developing capital market expectations across a range of asset classes is well developed in the developed markets, they are yet to gain great applications in the emerging market space. We have several major providers of capital market expectations like JP Morgan, Invesco and Research Affiliates whose calls on the long-term market returns is summarized in the appendix. While they may not be precise or accurate, nevertheless they give a sense of expectations that are structured based on good application of quantitative techniques.

Ad: Marmore Research Report

In the world of portfolios, the application of expected returns, risk and correlation cannot be emphasized more. They form the bedrock of asset allocation and meaningful client outcomes. However, undertaking such a task in the emerging market context is laden with several risks including that of lack of long history, quality of data, and wide range of scenarios possible given the fluidity of the situation. In general, returns are decomposed into the following three components:

- Dividend yield - Earnings growth & - P/E expansion or contraction

Projecting future returns is a function of various variables that should go into these three aspects. While emerging markets may exhibit some sort of stability in terms of dividend yields, they may experience erratic earnings pattern and P/E designs due to market inefficiencies and idiosyncrasies.

In the context of Saudi Arabia, which hosts the world’s biggest oil producer Saudi Aramco, the equity capital market is more developed than debt market. Hence, capital market expectations will lend themselves nicely to equity asset class. Equity markets may exhibit homogeneity in terms of dividend yield, but can exhibit heterogeneity when it comes to earnings growth and P/E behavior. Also they may have more dimensions in terms of Sharia and conventional. It requires good amount of sanitized data along with good application of quantitative techniques to develop future expected returns for Saudi Arabia equity markets.

Did You Know? Saudi Arabia is expected to enjoy the highest credit growth at 5.3% in 2020 - Learn more

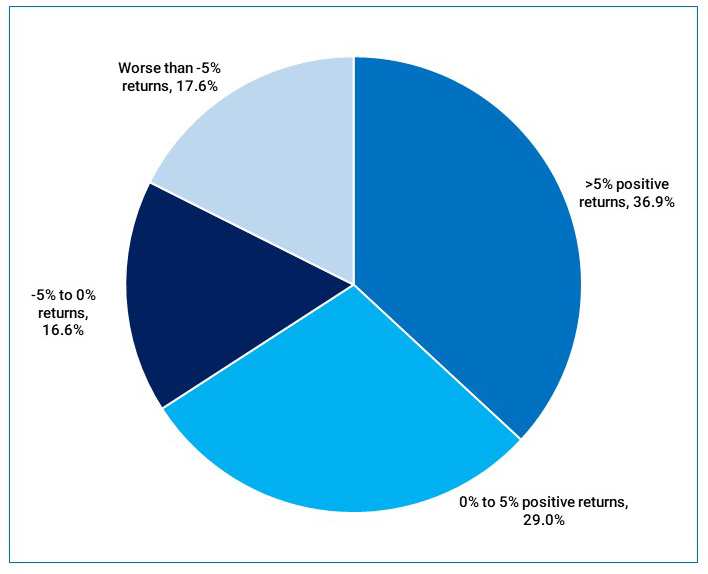

Marmore, recently conducted a poll on social media, wherein about 300 responses were received for return expectations of Saudi Arabia equity market for the 5-year period of 2020 – 2024. About 2/3rd of the total respondents hoped for positive returns, while 1/3rd of the respondents indicated negative returns. 37% of the respondents favored a return expectation of more than 5%, while 29% of the respondents expected returns to be range bound between 0% to 5%. Interestingly, among the respondents who expected negative returns, a majority of them voted for returns worse than negative 5%.

Results of Social Media Poll – Returns expectation for Saudi Arabia 2020-2024

Source: Marmore

Source: Marmore

Saudi stock market

following the successful listing of Saudi Aramco IPO has garnered the attention from investors worldwide. However, the lack of future return expectations for the Saudi stock market (Tadawul index) has been a hurdle for investors who would like to consider Saudi Arabia market in their portfolio. If developed it will help Investment advisors, portfolio managers and wealth managers to model their client portfolios based on objectively derived capital market expectations. This exercise will also help robo advisors engaged with developing portfolio management applications and other technology related aspects. Institutional investors like pension funds and sovereign wealth funds can also hugely benefit by having a long-term view on Saudi Arabia equity markets based on the market fundamentals.

Appendix

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More