Why are the breakeven oil prices coming down for GCC countries?

Marmore Team

11 January 2018

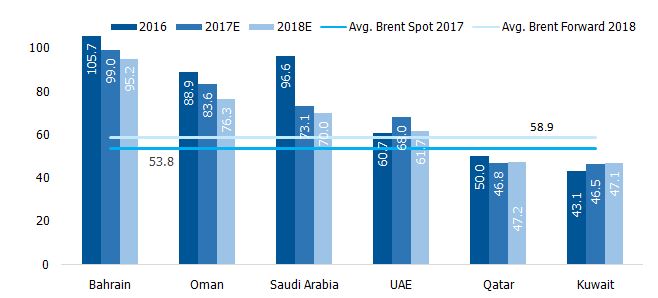

Fiscal breakeven oil prices (in USD/bbl)

Source: IMF

Fiscal break-even oil price is the minimum oil price needed to meet the spending commitments of oil-exporting country while balancing its budgets [BEP = {(Government Expenditure minus Non-oil revenue)/Oil quantity produced} + per barrel cost of production] (Fiscal Breakeven Oil Price). Prior to the collapse of oil prices, fiscal break-even oil prices were rising rapidly in GCC countries, reflecting the substantial increase in government spending by an annual average of 11 per cent in real terms in 2003-2014 (Gulf News). Moreover, the increasing government expenditures were largely due to rising salaries, wages and subsidies; expenses that were hard to control given the welfare economic model that is prevalent which subsequently made it difficult for the government to lower the breakeven oil prices. This led many analysts to think that lowering of BEP would be hard. However, the new realities due to low oil price environment had led to dramatic changes including curbing of subsidies and introduction of new non-oil revenue sources.

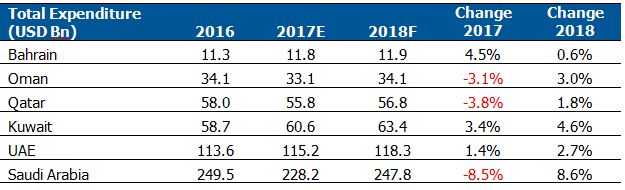

There are three main factors which drive the movement in fiscal GCC break-even oil prices. First is the value of hydrocarbon exports, second changes in non-hydrocarbon government revenues (accounted for 30 per cent of total government revenues in the past five years) and finally change in government spending. An increase in the value of oil exports, improving non-hydrocarbon revenues and a decline in spending will all contribute to lower fiscal breakeven oil prices.

Fiscal consolidation efforts by the government including restrained spending and growth in oil revenues (compared to the previous year) due to gradual rise in oil prices led to a decline in fiscal breakeven oil prices in 2017. Whereas in 2018, improving non-oil revenues is expected to be the main factor in reducing the breakeven prices. Unlike other oil-exporting countries, GCC currencies are pegged to the dollar, and thus most of the adjustment to lower oil prices has been on the fiscal side. Reduced government spending has so far been the most prevalent measure to lower break-even oil prices in the GCC countries after crude oil prices shed by more than half in the last two years.

Source: IMF

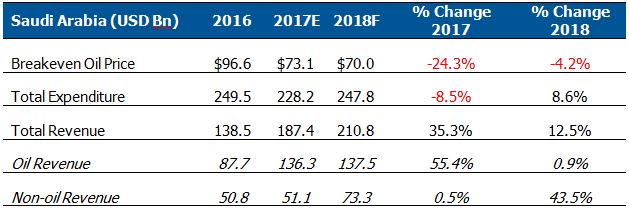

Additional adjustment in 2018 will focus on mobilization of non-hydrocarbon revenues, including higher fees and charges, introduction of value-added tax in early 2018 and privatization moves (IIF). As a first step, countries are introducing a VAT and other consumption taxes — for example on tobacco and sugar-sweetened beverages. Over time, governments may also consider deriving additional revenues from income and property taxation. These efforts are expected to raise revenues by 1-2 per cent of GDP, assuming a VAT rate of 5 per cent (IMF).

In Saudi Arabia, this would lead to much lower fiscal break-even oil prices, a decline of 24 percent from USD 96.6 to USD 73.1 per barrel of crude oil in 2017. Kuwait and Qatar will have break-evens below the oil price, more than enough to balance the budget in 2018. Overall, the weighted average fiscal breakeven oil price for the GCC has declined steadily since it peaked at USD 87/bbl in 2014 to USD 69/bbl in 2016 and USD 66/bbl in 2017.

Source: IMF, IIF

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More