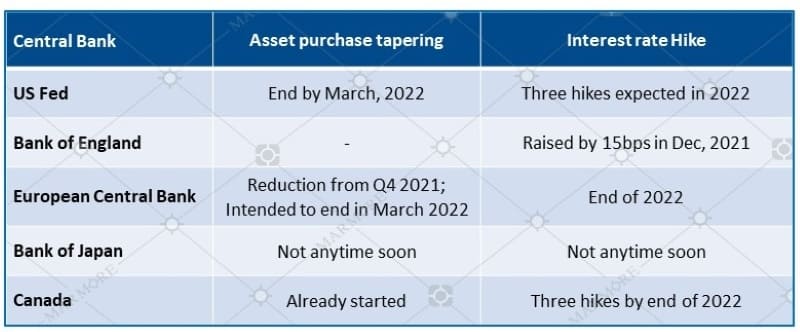

U.S. inflation has surged to the highest levels seen since 1990 at 6.2% (Y/Y) due to factors such as higher shelter and car prices, which are both expected to continue rising as 2022 starts. The Federal Open Market Committee (FOMC) voted to maintain the current Fed Funds rate at the zero-lower bound (0.00% – 0.25%) and accelerate the pace of tapering its asset purchase program to USD 30bn per month starting in mid-January from the current USD 15bn.

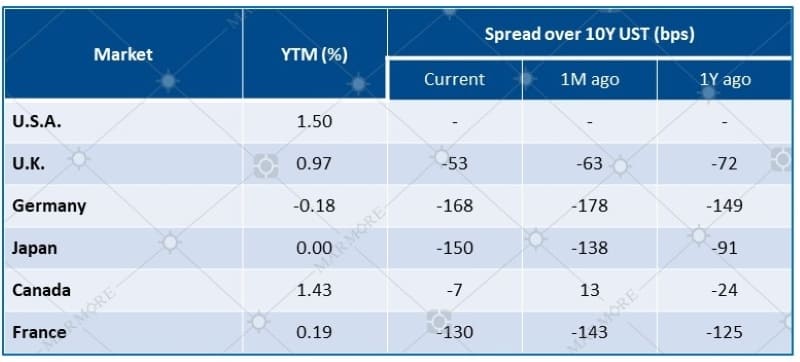

10Y Sovereign Yields

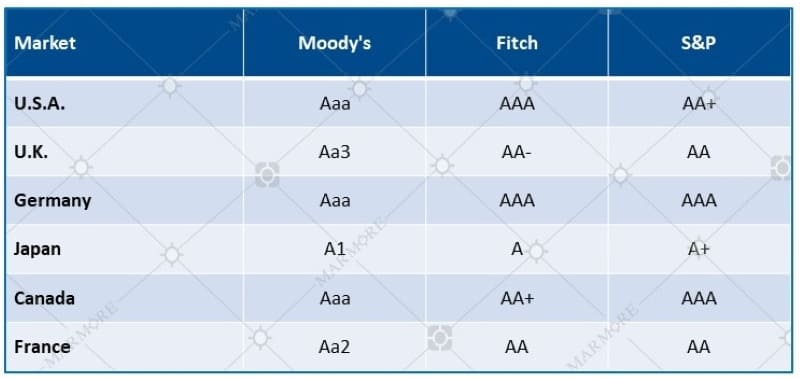

Sovereign Ratings

Investors received FOMC participants’ revised outlooks through 2024. Growth expectations were downgraded for years 2021 and 2023 but upgraded for 2022. Inflation expectations were revised up, forecasts for core PCE increased 0.7% to 4.4% in 2021, 0.4% to 2.7% in 2022, 0.1% to 2.3% in 2023, and steady at 2.1% in 2024. The unemployment forecast is steadying out at 3.5% in 2022-2024.

The median of the committee now expects eight rate hikes through 2024 starting in 2022. The median of the Committee expects three rate hikes in 2022 and 2023, and two rate hikes in 2024. The Fed’s long-run neutral rate of 2.5% was not changed.

Indications of possible Rate hikes/tapering from Central Bank

Rather unexpectedly, Bank of England increased its bank rate by 15 basis points to 0.25% for the first time since the pandemic citing a more persistent outlook on inflation and a tighter labour market. People’s Bank of China cuts the one-year loan prime rates by 5bps to 3.8%, in a move to support economic growth.

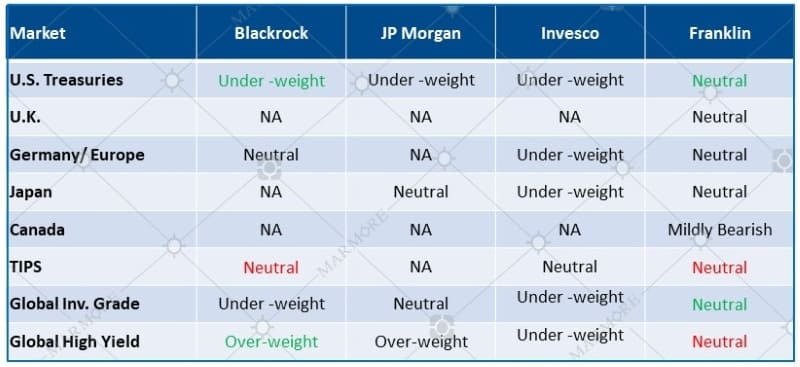

Risk assets such as high yield and Additional Tier 1 (AT1) bonds are expected to benefit from the strength of corporate health, along with attractive valuations and low default rates. Emerging markets present a more unclear binary consideration with a tailwind of cheap valuations contrasting with a tightening of monetary conditions from developed markets.

Fixed Income Views - as of Dec 2021

Source: Refinitiv, IMF, JP Morgan, Franklin, Moody’s, Fitch and S&P Colours in Equity views indicate upgrade (green)/downgrade (red)

Source: Refinitiv, IMF, JP Morgan, Franklin, Moody’s, Fitch and S&P Colours in Equity views indicate upgrade (green)/downgrade (red)

Know more about the performance of GCC and Global markets in December in our recent Global & GCC Capital Markets Review. Read more

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

Kuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More