Several factors argue for the case for a unified stock exchange in the GCC region including increased trade volumes, improved liquidity and lower trading costs on back of economies of scale (MENA Asset Management Policy Perspectives, Markaz Research) . However, the first step towards such unification of stock exchanges requires the union of currencies and harmonizing of monetary operations undertaken by the GCC central banks.

Initially proposed in the early 2000 after the successful adoption of the Euro, the approval for the new economic agreement came in 2001. The agreement included deadlines to establish the minimum requirements for the establishment of the GCC monetary union. The requirements included the standardization of banking regulations and the synchronization of monetary and fiscal policies.

Nevertheless, the deadline for the proposal for the adoption of a common currency, known as Khaleeji, by 2010 was plagued by several developments. The first was in 2006 when Oman opted out due to their inability to meet the required convergence criteria. All the GCC countries had earlier pegged their currencies to the US Dollar in January 2003 for the unification process, but when in May 2007 Kuwait removed its currency peg, the progress received a further blow. Kuwait blamed the rise in domestic inflation, double the historic average, stoked by sliding dollar which increased the cost of imports as the reason. In 2009, UAE also backed out of the proposal for a common currency after the other GCC countries provisionally agreed that Riyadh, Saudi Arabia would hold the Gulf Central bank for this common currency . UAE did not agree to the location of central bank decision and criticized the fact that most GCC institutions were headquartered in Saudi Arabia.

Parallels in Europe, the adoption of the Euro helped eliminate the currency risk for investors and helped them to broaden their portfolios by taking part in cross-border investments. Though currency risk per se doesn’t exist among GCC member countries as they all are pegged to the common currency (source: Arabnews, Gulfnews) and the peg is backed by substantial reserves, nonetheless the move would help in eliminating the frictional costs that the investor would incur when shifting from currency to another.

In 2010, at a meeting in Riyadh, UAE floated an initiative aimed at integrating the securities markets of all the members of the GCC. They did not propose a single stock exchange but only a consolidation of rules and regulations, as the basic step before any other measures for further progress could follow. The proposal also included a strategy that would be implemented in steps over a certain period of time.

Apart from removing the frictional costs, the unified currency can be advantageous in the following ways:

- Strengthen bilateral trade and two-way investments between the GCC countries.

- Ensure stability of prices in all commodities within the region.

- Since the countries would be able to pay the regional imports in the new currency, this would allow them to no longer keep aside foreign exchange for the intra-trade transactions among GCC nations.

- The integration of financial markets resulting in more potential investments.

Despite this, some experts believed that the unification of currencies will not serve any special purpose and considering the structural issues that the Gulf countries have, they would be better served by having an independent monetary policy which may not be possible in the case of a monetary union.

Yet, if the GCC countries do succeed in adopting a common currency, resulting in a unified stock exchange, the benefits would be manifold. Some of them include:

- Well regulated unified stock market will change the way investors work with the management, changing the orientation and undertaking projects which create value for the investors. This change in orientation could mean better disclosures from the companies in terms of financials and better transparency in the operations of the firm.

- It will create the required size and liquidity, i.e. the other low and mid cap stocks will also come into focus and not just the GCC bellwether stocks, necessary to attract the foreign institutional investors.

- A competent single stock market can facilitate in the introduction of different financial products so desperately required in the GCC. For example, the availability of hedging products in the market could invite keen interest from the regional and international participants.

- It may provide a better valuation for firms and help promote mergers and acquisitions.

- A large unified stock market is also much better than a fragmented one in terms of integration into the global markets. This will help the countries counter the shocks or the fluctuations in the market they are currently vulnerable to.

Having said that, it is also worth mentioning that despite global integration the stock markets would still be susceptible to volatility due to the short term interests of global institutional investors.

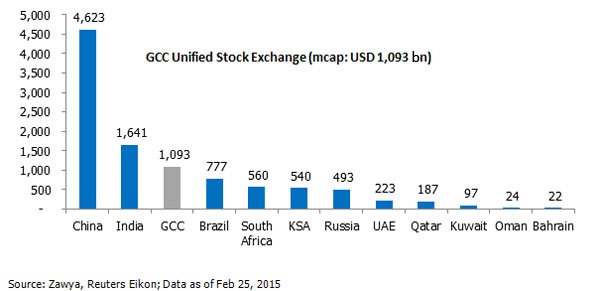

Figure: Stock Market Capitalization of Various Countries (USD bn)

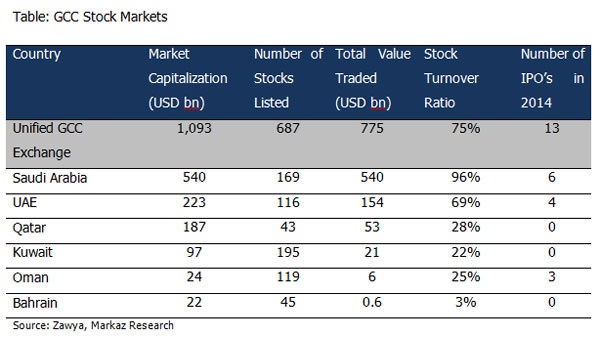

Unified GCC stock exchange would have a daily turnover value of USD 3.1billion and command a market capitalization of approx. USD 1billion, which is much higher than that of Brazil, South Africa or Russia. But to even think about the possibility of a unified stock exchange and to enjoy the benefits mentioned above, it needs to overcome the following challenges:

- An efficient stock market is highly correlated with a sound banking system so the supervision of banks and financial intermediaries to meet international standards should be adhered to.

- Transparency and clarity in legislations is required if the stock market wants to compete internationally. (Gray, S. and Blejer, M., 2007. The Gulf Cooperation Council Region: financial market development, competitiveness, and economic growth)

- To boost the confidence in markets and to ensure equal participation, appropriate framework for the disclosure of material information should be established.

- Strengthening the institutions that need to manage the single currency and enhancing the market infrastructure including trading platforms and settlement systems should be expedited.

In 2010, officials from the four GCC nations of Saudi Arabia, Kuwait, Bahrain and Qatar met to discuss the unified rules for the supervision of their banks ahead of the launch of the monetary union.

However, as of 2014, no noteworthy announcements have been made about the developments in this regard.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More