Price-to-earnings multiple for UAE fell by 13% in 2015 and currently stands at 10.4x. The fall has been the most in Dubai index, wherein, the P/E multiple contracted by 25% from 12.4x at the start of year to a current value of 9.3x. UAE markets seem attractive for investors with P/E ratio of 10.4 while its comparable peers Kuwait and Saudi Arabia are slightly overvalued at 14.4 and 13 respectively. On P/B basis, UAE (1.3) is slightly overvalued than Kuwait (1.1) yet attractive compared to Saudi Arabia (1.5) and Qatar (1.6). The drop in stock prices due to unfavourable investor sentiments was the reason for valuations to decline after 2013. Dividend yield forecast for UAE also remains attractive at 4.2%.

Earnings: Positive

We expect corporate earnings growth to be flat in 2015 and gradually grow by 5.1% in 2016 led by banking sector. According to Marmore’s UAE stock market outlook for 2016, while the lower oil prices could affect the deposit mobilization process and subsequently the credit off-take, we believe the banks are well-capitalized and enjoy ample liquidity to minimize risks posed by the lower oil environment. We expect the earnings in UAE to grow by 5% next year as the banking sector which constitutes about 80% of the corporate earnings is expected to witness 5% growth in 2016. Earnings from the banking sector can push the earnings to grow in 2016 despite the declines anticipated for telecom and real estate companies. CBRE predicts the real estate prices in Dubai and Abu Dhabi to fall further in 2016. Lower ARPU (Average rate per user) in UAE may hit the top line of the telecom companies.

GDP growth in UAE is expected to be moderate (3.3%) in 2016 on account of scale back in public spending, especially in Abu Dhabi, on account of lower oil prices. Catalysts in the form of hosting Expo 2020 and lifting of sanctions in Iran could boost investment and trade activity in the coming years. UAE’s large reserves will help them to intensify the diversification process and focus on non-oil driven growth for the future. The lower projection for UAE is mainly due to the lower activity in Abu Dhabi from where the country receives the major chunk of oil output. UAE economy is expected to see sluggish growth activity till 2017 and move towards higher growth trajectory after 2017. Inflation in UAE is expected to ease at 3% 2016 compared to 3.7% in 2015 as the cost of transportation and fuel have declined with the decline in oil price. Diesel prices have declined by 18.2% in 2015. UAE however stands next to Kuwait among the GCC countries with Oman’s inflation expected to be the lowest at 2%.

Market Liquidity: Neutral

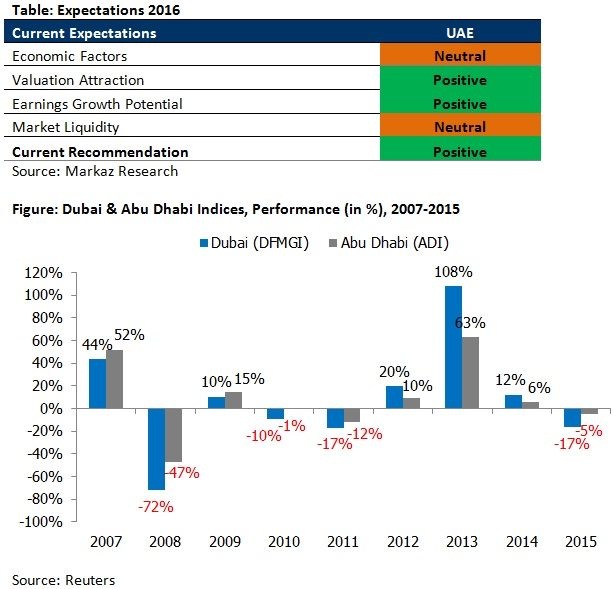

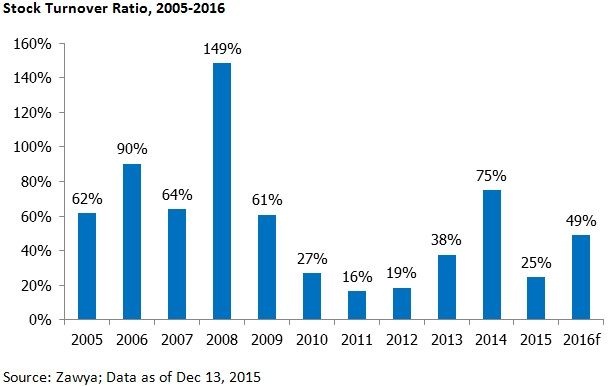

Value traded in UAE markets plunged by 66% Y-o-Y in 2015 after its 248% and 124% increase in 2013 and 2014 mainly due to the country entering the MSCI Emerging Markets Index. The declining stock prices owing to sell-off spree from the institutional investor and fund managers was the major reason for the decline in value traded in UAE.

Concluding Remarks

In sum, we believe that 2 out of 4 factors are Positive for UAE with the others being Neutral and hence we will continue to maintain our positive stance on the UAE market. The four-force analysis depicts the strength of the UAE economy especially in terms of valuation and earnings potential. Economic factors such as the positive trade balance, robust GDP growth and lower levels of inflation provide cushion to the economy despite the drop in government revenues. Valuations for UAE stocks remain attractive for investors compared to markets like Saudi Arabia and Kuwait. P/E ratio of UAE was 9.3 in 2015 compared to 14.4 in Kuwait. We expect the valuations in the UAE market to remain attractive in 2016. Liquidity in the markets is also expected to improve as value of stocks traded is anticipated to move upwards in 2016 with better earnings forecasted. UAE market is expected to remain resilient to the oil shock with the reforms of the government such as subsidy cut and fiscal consolidation expected to pay-off from 2016.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More