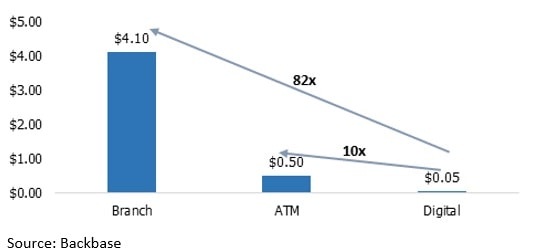

The western countries, especially the US, have adopted technology at a much faster pace than the rest of the world. At present, almost 80% of Fintech investment happens in the US, followed by the UK. Developed markets in the Asia Pacific have also been investing and implementing Fintech solutions in recent times. However, adoption in the GCC is still in its infancy. But with growing awareness, Fintech is slowly breaking ground in the region.

Digital-only banking

Digital-only banking is the new wave that is expected to change the way the banking industry works. In a survey conducted by EY, almost 78% of GCC customers indicated that they would be willing to switch banks for better digital banking experience, and 64% would feel comfortable switching to a digital-first bank. Unlike traditional banking, which is more branch-centric, digital-only banks would avail them more independence in utilizing the services offered by the bank.

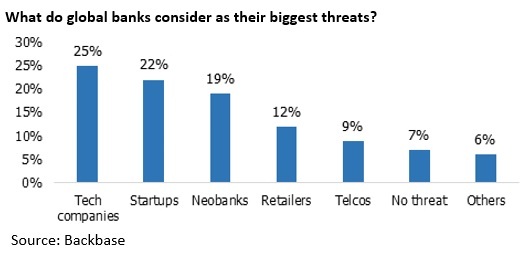

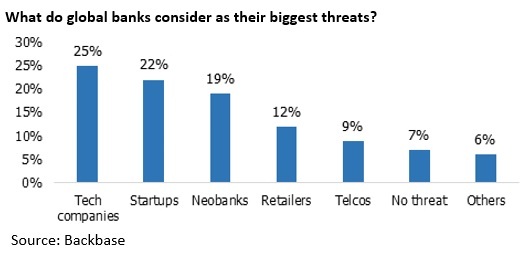

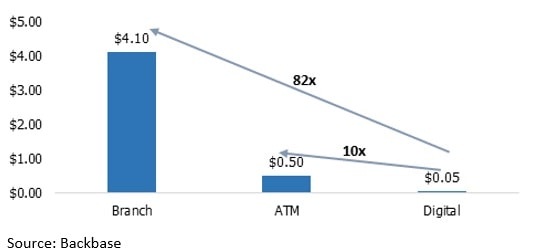

The cost-per-customer-visit for traditional branch-based banking is multi-fold, compared to digital-only banking. Traditional banks spend an estimated 40-60% of the total operating costs in the maintenance of branch networks, which the digital-only banks eliminate. Fintech firms are a threat to traditional banks that offer similar services at a much higher cost. These firms have already begun cannibalizing on the traditional banks’ customer base, thereby pressurizing the margins of the latter.

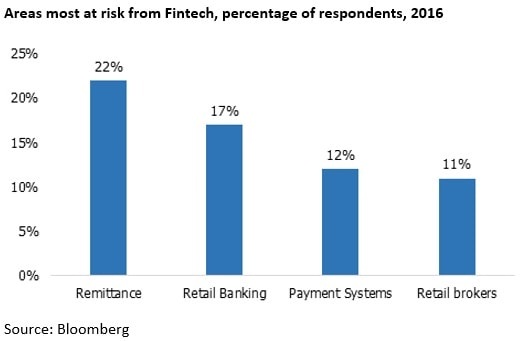

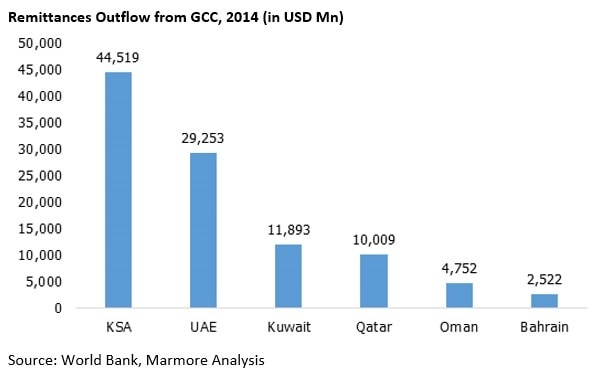

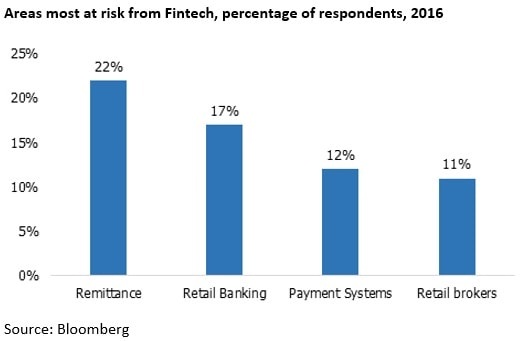

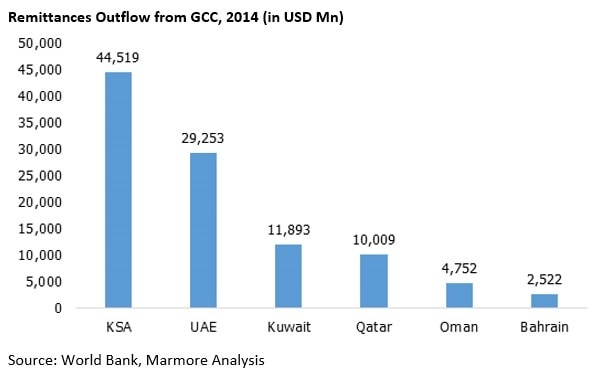

Remittance

Global remittance industry was estimated to be worth close to $650bn, at the end of 2015, and is growing at a CAGR of 3.75%. Saudi Arabia and UAE occupy the second and third spot in global remittance send volume, accounting for a combined USD 74bn, majority of which goes to India (USD 23bn), followed by Pakistan (USD 9bn) and Philippines (USD 7bn). According to the World Bank, the cost of sending money home to diaspora averages 7.7% globally. But Fintech players are emerging in the horizon, leveraging on online and mobile platforms, and have increased the pressure on banks by charging an average fee of 0.9%; much less than the average for banks (global average). In 2015, the cost of sending remittances to the MENA region decreased 95bps from 8.37% to 7.42%.

P2P Lending

Beehive, a Dubai-based sharia compliant P2P lender, is the UAE’s first online platform for lenders and borrowers. It provides low cost finance to SMEs, while providing a direct access to alternative asset classes that can potentially generate higher returns to investors. According to Beehive, people just invest 5% of their net wealth on such platforms, but witness returns of 15%-20%, on an average. This has encouraged more than 2,000 investors to register with the platform in the UAE, which has successfully completed 100 deals since inception. P2P lending could change the way lenders and borrowers interact in the future, in both the retail and commercial banking spaces, as it offers attractive returns for lenders and cost efficiency for the borrowers. Platforms such as Beehive can serve as a funding source for the Small and medium enterprises (SMEs), though they might not be able to replace banks in funding big ticket corporate credit.

Islamic Finance

According to Marmore’s report on ‘Fintech in GCC’, one of the biggest potential impacts of Fintech will be on Islamic finance. Fintech could potentially increase the reach of Islamic financial services, and provide more choices that suit individual needs at competitive cost. SMEs that find it hard to obtain sharia-compliant bank funding from Islamic Financial Institutions (IFIs) could look to Fintech firms to fill that gap. Fintech’s penetration into Islamic finance is expected to intensify competition among traditional IFIs. Some of the Islamic finance players that have ventured into Fintech include Abu Dhabi Islamic Bank (ADIB), Dubai Islamic Bank (DIB), and National Bonds, a shariah-compliant savings and investment firm. ADIB has teamed up with IBM to build a digital studio that will work on digital innovation projects across the bank. Conventional Islamic banks seek to expand their presence in the Fintech space by adopting technology in their service offerings.

Crowdfunding

Fintech firms have created platforms for lenders and borrowers to meet, without the need for a middleman, which in many cases are traditional banks. Crowdfunding and Peer-to-Peer (P2P) lending are the new buzzwords among borrowers in recent years. In 2015, the global crowdsourcing market was expected to have grown by an estimated 112%, to reach a value of $34.4bn. The GCC region has also witnessed the emergence and the growth of the crowd funding concept, and experts opine that crowd funding would continue to grow due to dearth of venture capital and public offerings for entrepreneurs. For instance, a UAE-based platform, Eureeca, calls itself a crowd-investing arena, as it allows interested investors to view profiles of available projects to invest in. In return, the investors will gain shares in the businesses, in which they make their investments. Investors might divert more money into these crowd funding platforms for better returns and borrowers will have an alternative avenue apart from the traditional banks. Crowdfunding might impact private equity firms in GCC, as start-ups might find it as an easy alternative to raise capital.

Conclusion

Fintech firms have already made their presence felt across the globe, with innovations such as digital remittances, robo-advisory, algorithmic trading, and P2P insurance and lending platforms. Surprisingly Banking and Financial Services Industry (BFSI), the biggest and most prominent sector in the GCC, is yet prepare for the entry of Fintech in the region, as potential competition. In the coming years, the demand from consumers is expected to give rise to faster adoption of these technologies across various verticals in BFSI. Traditional banking and financial service players will have to improve their operational efficiency by cutting down on needless expenditure, adopt technology, where possible, and improve their asset quality, if they wish to compete with their digital cousins.