Saudi Arabia Banking Sector – The worst might not be over yet

Marmore Team

05 October 2020

COVID-19 pandemic has pressurized banking asset quality and increased the demand for credit. As signs of normalcy returns, banks face the challenging task of managing the asset quality while expanding balance sheets. The strength of a country’s banking sector is often reliant on its underlying economic conditions. As is the case for Saudi Arabia, which has the second largest banking industry in the GCC by total assets, with roughly 29% of the region’s total banking assets. According to estimates from Al Rajhi Bank, Saudi Arabia’s economy is expected to contract by 6.8% in 2020, affected by low oil demand and pandemic related lockdown measures. Sectors such as energy, logistics, transport, aviation, retail and manufacturing are likely to be among the worst affected. Banks having large exposure to these stressed sectors are expected to witness deterioration in asset quality, which would increase provisioning and ultimately affecting their bottom line. We have covered Saudi Arabia’s banking sector in greater detail in our recently published report ‘Saudi Arabia Banking: Caught in the COVID-19 Grip', which includes the forecasts for 2020 after considering the impact of COVID-19 pandemic on domestic banks.

Bank credit in Saudi Arabia witnessed an uptick at the end of 2019, increasing by 7.6% and trended upwards in the start of 2020 due to the pickup in real estate loans related to the government’s housing program. Disbursement of credit has fallen since the lockdown measures were put in place, with credit uptake expected to stay below pre-COVID-19 levels in the near future. Deposits witnessed a robust year-on-year growth of 18.2% in 2019 due to the increase in public sector deposits, which were largely from the proceeds of Saudi Aramco’s stake sale. Deposit growth is likely to slow down in the remainder of 2020.

Ad: Marmore Research Report

Saudi Government and the Central bank have been using fiscal and monetary tools to soften the economic impact of COVID-19. Relief has been provided to borrowers in the form of deferment of loan repayments, due to which the impact on non-performing loans were masked in the second quarter earnings result in 2020. NPL ratio of Saudi Banks have been low in the past few years and stood at 1.9% at the end of 2019. A spike in bad loans is expected once the deferment relaxations are removed, showing a much clearer picture of the banking sector in terms of asset quality. A key risk that could emerge would be the interplay of receding stimulus measures and the potential asset quality deterioration. Liquidity remains intact with the Liquidity Coverage Ratio (LCR) declining slightly in 2019. Deposits remain the primary source of funding for Saudi banks. Deposits are mostly in local currency and make up more than 90% of total funding in Saudi banks. This proportion is the highest among other GCC countries, providing a strong cushion from a liquidity perspective.

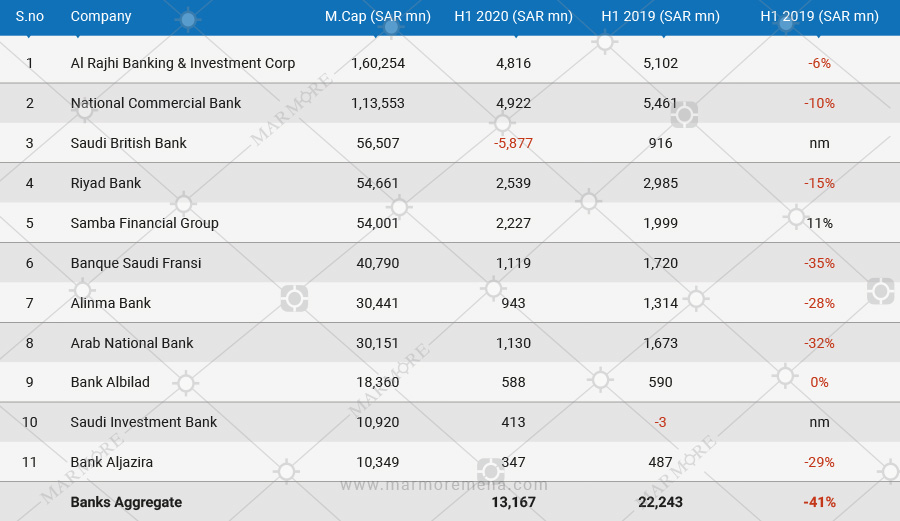

Aggregate revenue of listed Saudi banks grew by 6.5% in 2019, with interest rate cuts not having a negative impact on interest income. However, shrinking net interest margins, sluggish credit growth, increase in bad loans and higher provisioning are expected to affect profitability of banks in 2020. Accounting for slippages and the necessity for higher provisioning due to the anticipated increase in bad loans, net income for the full year 2020 is expected to fall sharply. In the first half of 2020, aggregate net income of listed Saudi banks fell by 41% on a year-on-year basis.

Did You Know? Saudi Arabia is expected to enjoy the highest credit growth at 5.3% in 2020 - Learn more

Net income of Listed Banks in Saudi Arabia

Source: Refinitiv

Source: Refinitiv

Business models of banks would also undergo a transformation owing to the change in customer behavior. The transition towards digitalization of banking services will gain further traction in the coming years as customers start getting accustomed to digital modes of banking during the pandemic time where direct interactions between personnel is discouraged. Banks are likely to invest heavily in technology during the downturn to gain a competitive edge over technologically advanced fintech players who are looking to gain market share at the expense of banks. Partnerships between fintech companies and banks is also likely to take place, with each of them trying to capitalize on the other’s strengths. There could be further consolidation of the banking sector through mergers and acquisitions in the near term to create stronger entities that are more resistant to economic shocks. Overall, Saudi Arabia’s banking sector faces a stern test during the rest of the year, with the worst yet to come.

The above contents are part of our full report, which delves deeper into Saudi Arabia’s banking sector and the sectoral impact caused by COVID-19 pandemic.

To know more, click the following link: ‘Saudi Arabia Banking: Caught in the COVID-19 Grip'

Ad: Marmore Research Report

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More