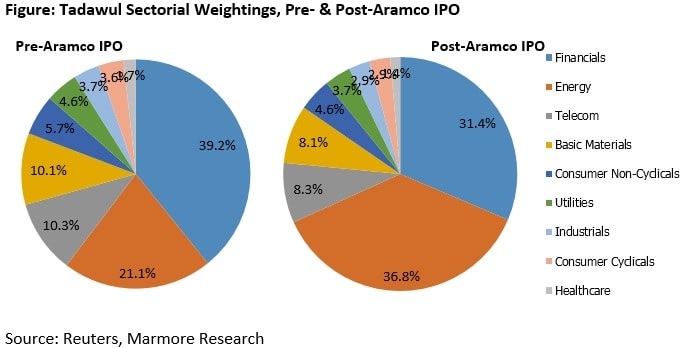

The market capitalization of the Saudi Arabian stock market is currently around USD 400bn and the IPO of Aramco could add further USD 100bn to the market capitalization (Financial Times). Inclusion of Saudi Aramco in energy sector would increase its weightage from the current value of 21.1% to 36.8% in the Tadawul index pushing the dominant financial services sector from the top spot. We believe the revised weightage where petrochemicals/energy sector dominates the index rather than the financial sector is a better representation of the underlying economic structure of Saudi Arabia.

Further, one may consider dual-listing of Aramco in well-established stock exchanges such as New York or London apart from the domestic market. Though international listing could boost the confidence of investors and draw greater demand and investor attention for the offer it could entail enhanced disclosures of information and financials, which Saudi Arabia may be hesitant about.

China is vouching for dual listing of Aramco that would put the government-owned oil giant’s shares on both the Hong Kong and Saudi exchanges in return for anchor investments from the Chinese funds. Hong Kong exchange had IPOs worth USD 34bn last year surpassing USD 30bn raised by IPOs in U.S, and therefore winning the mandate could boost Hong Kong stature further. Moreover, 16% of Chinese oil imports are from Saudi Arabia; establishing a stake in Aramco could further increase the synergies between China and Saudi Arabia.

Alternatively, an Exchange Traded Fund (ETF) could be setup and allowed for trading wherein the underlying asset is Saudi Aramco. This has the advantage of not ceding ownership and provides only the right to ownership over Aramco assets.

Listing of Aramco would be a landmark event not just for Saudi Arabia but for the global capital markets. Successful listing could pave way for trimming of government stakes in other large private entities. Considering liquidity pressures which the offer might experience in case of listing in the domestic market, it might be wise to consider other options which include dual listing. This will also boost the confidence of the foreign investors on the Saudi Arabian companies which might pave way for future listings of Saudi companies abroad.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More