Kuwait’s All Share index gained 27% in 2021 supported by recovery in oil prices

Marmore Team

19 January 2022

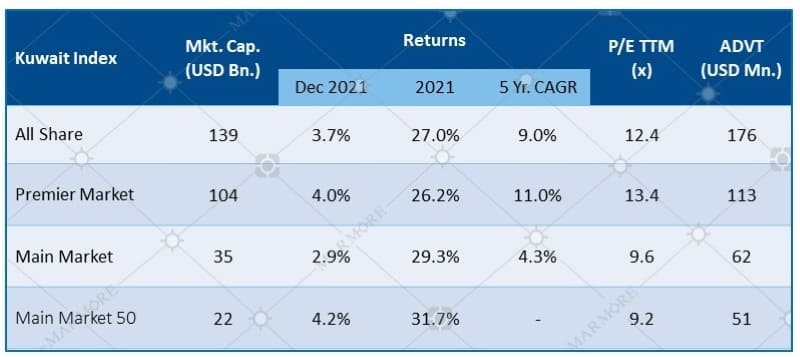

Kuwait markets ended the year positively, with the recovery in oil prices supporting gains. Kuwait All Share index gained 27.0% in 2021, following a rise of 3.7% in December.

Market Performance & Key Metrics

Source: Refinitiv

Source: Refinitiv

Sectoral Performance & Key Metrics

Source: Refinitiv

Source: Refinitiv

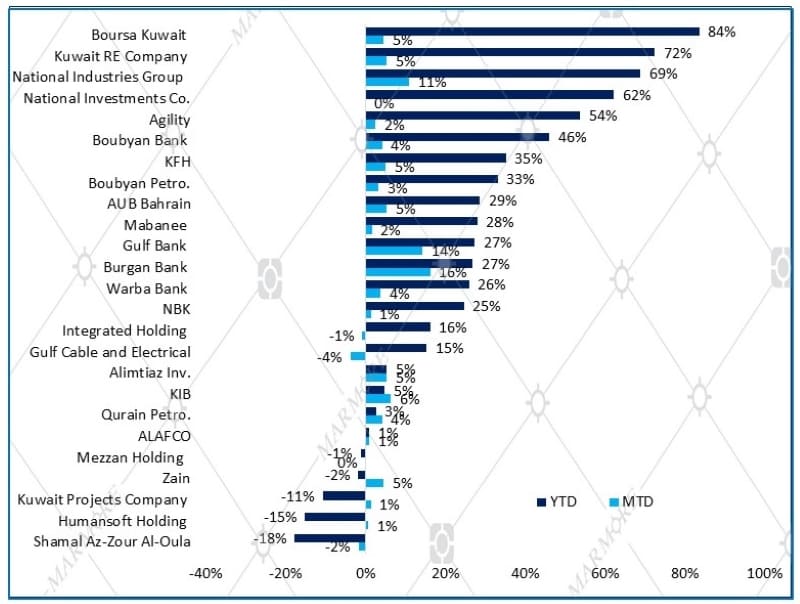

Premier Market Stocks' Performance

Source: Refinitiv

Source: Refinitiv

Know more about the performance of GCC and Global markets in December in our recent Global & GCC Capital Markets Review. Read more

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

Kuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More