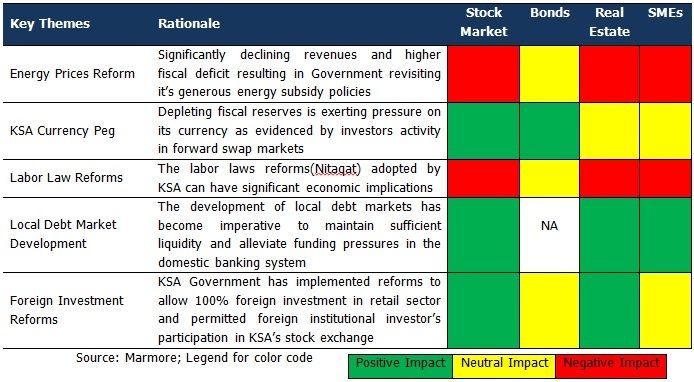

The government of KSA over the past few decades used perks such as lower energy prices, food & water subsidies and absence of taxes for individuals and domestic corporations to distribute the oil wealth to its citizens. The subsidized energy prices translate into significant costs for the government, estimated at USD 107bn or 13.2% of the gross domestic product in 2015. However, the low oil price environment calls for prudent assessment and reforms in these subsidies to achieve sustainability of government finances on a long-term basis. The low energy cost has also resulted in substantial increase in per capita energy consumption in KSA. According to Marmore’s KSA economic themes report, GCC countries consumed 9.2 tonnes of oil equivalent (TOEs) per capita in 2014, as against the world average of 4 TOEs per capita. On December 29, 2015, KSA increased the price of higher-grade unleaded petrol to USD 0.24 (SAR 0.90) per liter from USD 0.16 (SAR 0.60), a hike of 50%. Lower-grade petrol has been hiked to USD 0.20 (SAR 0.75) from USD 0.12 (SAR 0.45) per liter. The direct impact higher energy prices on inflation is expected to be low as the weightage of energy products in the consumer price index (CPI) is relatively small for KSA. The reform is expected to result in negative shocks to productive sector. However, in in the long-term, energy price reforms are expected to generate income gains, rational consumption and improved efficiency contributing to the economic growth.

Local Debt Market Development

For the first time since 2007, the Kingdom of Saudi Arabia raised funds through bond issuance. KSA is expected to continue raising funds from bonds markets to plug the fiscal shortfall. Raising debt in the domestic market, if done in a measured way, could help in the establishment of an active and liquid debt market. Moreover, regular issuances of sovereign bonds could help deepen the Saudi debt market which could potentially flag off strong corporate issuances. The creation of a robust corporate debt market will shift the corporate risks into the capital markets and away from the banking system. This will create a more stable and well balanced financial system. Additionally, the availablilty of debt at the cheaper rate relative to the opportunity costs for Sovereign Wealth Funds (SWFs) make debt a more viable option.

KSA Currency Peg

The emerging markets have historically witnessed a push in their economic output after the devaluation of their currencies. Most of the world’s biggest oil and commodity exporter’s currencies have lost value during 2015. However, Saudi Arabia has continued to maintain its peg to USD and due to which it is spending more FX reserves during a low oil revenues regime resulting in lower inflow of FX. The currency depreciation benefits the country’s oil producers, since they pay for oil production in local currency, but receive revenues in dollars. If KSA continues to hold its peg, its revenue from oil would continue to decline, unless the oil prices increase. The longer oil languishes, the more pressure builds on Saudi Arabia to abandon its currency peg. However, the rate of the reserves' decline is likely to slow as the fiscal deficit would shrink to 16% of the gross domestic product in 2016 and the current account balance is set to return to a surplus from 2.4% deficit in 2015. All these factors clearly imply the unlikelihood of Saudi Arabia abandoning its currency peg to the USD.

Labor Law Reforms

KSA’s dependence on foreign labor helped KSA overcome the shortage of local labor. However, it has created distortions in the KSA labor market and resulted in increased dependence on nationals for public sector employment. These distortions constraint the ability to employ fast growing educated national workforce in the private sector. As the private sector continues to employ expatriates it has resulted in high unemployment rates for nationals, particularly among youth. Realizing these challenges, authorities in the KSA have adopted a reform strategy with the objective of increasing employment of Saudis in the private sector. However, measures are also required to improve the attractiveness of wages in private sector at par with public sector. In order to limit any potential fiscal, inflationary, wages and macroeconomic disruptions, it would be ideal to gradually substitute expatriate with the national workforce.

Foreign Investment Reforms

KSA was ranked as the third largest FDI recipient in Western Asia, after Turkey and the United Arab Emirates during 2014. However, it has experienced a steady decline in foreign direct investment since 2011 and the trend is expected to continue in the near future. In-order to turn around this downward trend and to diversify the hydrocarbon-dependent economy to reduce the shocks of oil slumps and create jobs for nationals, the Government has embarked on several reforms. Opening of Tadawul to foreign investors and permitting 100% FDI in retail sector are some of the reforms introduced to attract foreign investments in KSA. KSA’s decision to open its retail market to foreign investors is set to attract USD 2.66bn of foreign investments in the next year.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

Kuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More