GCC Population Will Be Lesser and Older by the End of this Century

Jenevivu Lasrado

21 June 2022

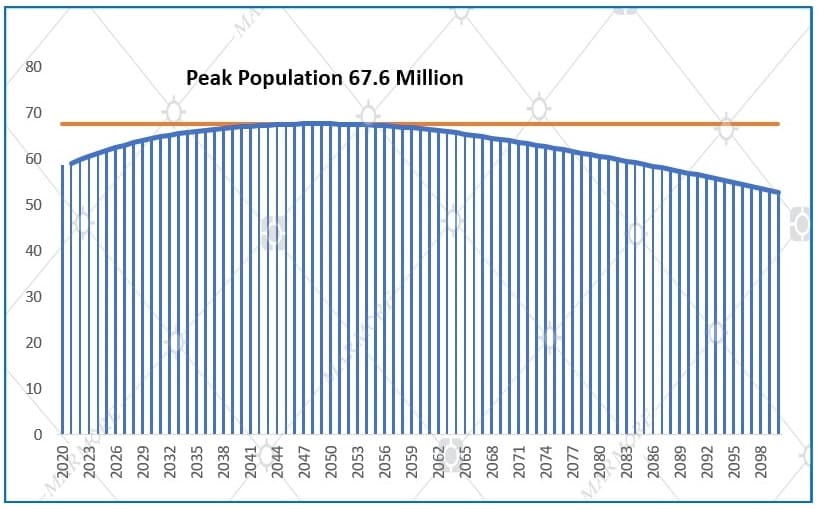

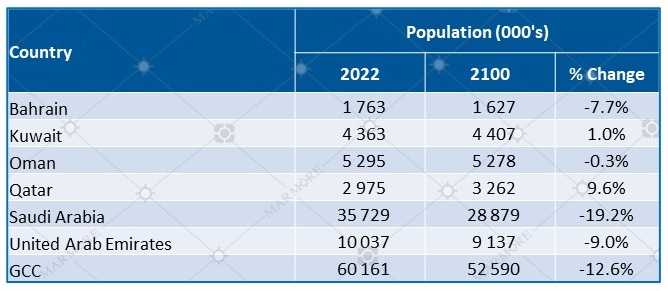

GCC Countries’ population is expected to reach its peak of 68 million in 2048 and decline thereafter, according to the UN World population prospects (low variant - In the low variant, total fertility is projected to remain at 0.5 births.) forecast. GCC population is expected to shrink by 12.6% to 52.5 million by the end of this century. Saudi Arabia and the United Arab Emirates will have the largest population contraction among the GCC countries, with declines of 19.2 % and 9%, respectively by 2100. Bahrain and Oman will also see a downtrend in the population of 7.7% and 0.3% respectively by this century. While Qatar and Kuwait will have an increase in population by 9.6% and 1% respectively.

GCC Population Projections (Millions)  Source: UN World Population Prospects

Source: UN World Population Prospects

Country wise Population Projections

The major reason for a possible population contraction is the declining fertility rate and the decline in the expatriate population. The total fertility rate (TFR) of a population is the average number of children born to a woman over her lifetime. The total fertility rate for the GCC region is 1.8 in 2022 which is less than 2, the replacement level rate that is needed to hold the population constant. TFR is expected to decline further to 1.15 by 2060 which will significantly reduce the population.

GCC Fertility Rate

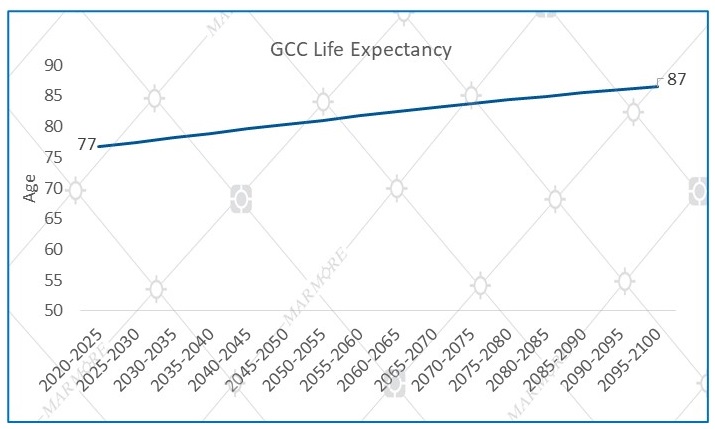

GCC Life Expectancy

Population profile of GCC countries’ is unique compared to other countries, as expatriates account for a substantial proportion of the GCC population in varying degrees in different GCC countries. With the diminishing world population expected in the coming years, the expatriates migrating to GCC countries could also significantly reduce, consequently leading to a decline in the GCC population.

Check Our Report :"GCC Food & Beverage Sector"

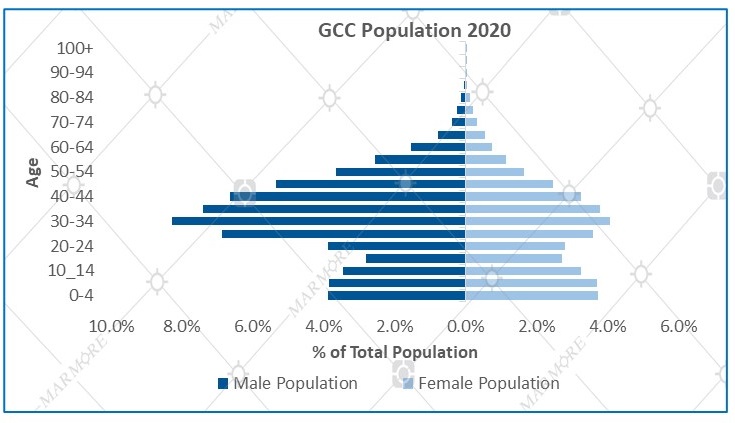

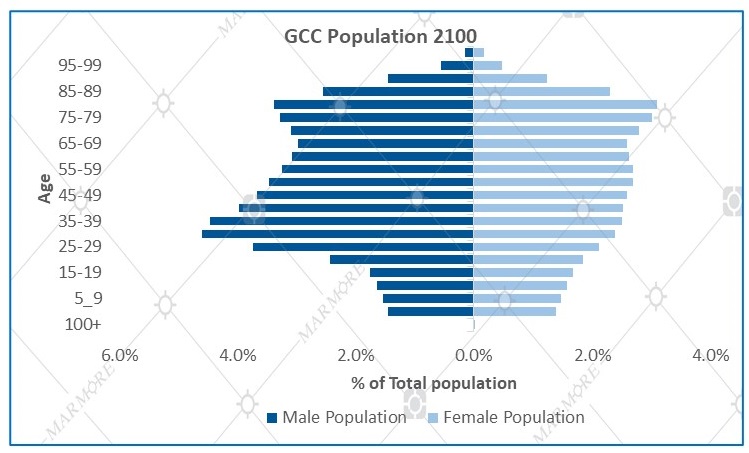

GCC population is expected to become significantly lesser and older by the end of this century. The median age of the GCC population will rise to 51 in 2100 from 32 in 2022. The old-age dependency is ratio of the population ages 65-plus supported by the population ages 16-64. The old-age dependency of GCC will increase over time and reach 60.2 in 2100. This indicates that every 100 working people should support 60 old age people in GCC by 2100.

GCC Population Pyramid

Dependency Ratio in GCC

Impact of declining population on various asset classes: Equity: The impact of this population contraction on the economy can be huge as the overall demand and supply in both domestic and global markets will fall substantially. There are two possible course for equity market. Due to a fall in demand, companies must reduce their supply, which consequently would downgrade their revenue and profits. The equity market will become unattractive to investors till the population cycle reaches the early expansion stage. However, there will be greater financial inclusion, and many more individuals will have investing knowledge and be comfortable with technology, which will lead to an increase in active trading accounts, which would help sustain the equities market. As the global population would be aging, cash and carry equities, mutual funds, exchange traded funds (ETFs), which are less risky compared to options and futures trading would become preferred among the equities asset class.

Also Read:"Kuwait Retail Sector"

Fixed Income: Retirement funds have a significant proportion of fixed income securities in their portfolio. Hence, the fixed income market will perform well and would be attractive due to the growing aging population that will become risk averse.

Commodities: Demand for major commodities could witness a downtrend due to reducing demand. On the other side, the supply costs for commodities would increase owing to labor shortages. Oil demand would reduce due lower energy requirement as the mobility and transportation requirements of the aging population would remain lesser.

Real Estate: High dependency ratio and lesser younger population would imply that community living, living with medical care would become the preferred choices for older people. Demand for individual villas, apartments could witness a substantial decline as demand from working age group might decline.

Also Read Our Reports:

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

Kuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More