GCC markets ended 2021 positively supported by sharp recovery in oil prices

Marmore Team

24 January 2022

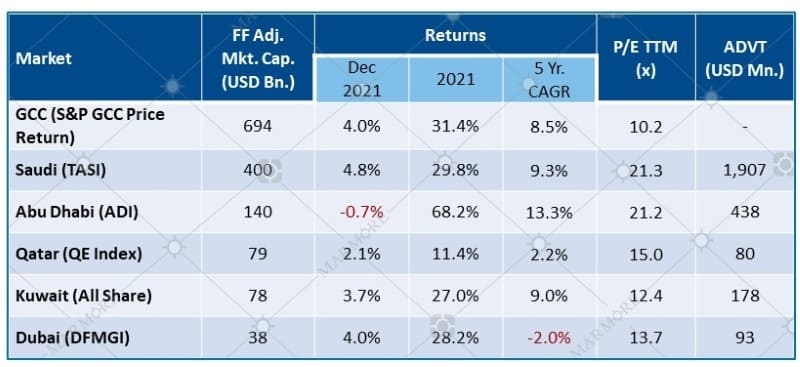

GCC markets had a very positive year in 2021, supported by the sharp recovery in oil prices. The S&P GCC composite index ended the year with gains of 31.4%, following a 4.0% rise in December 2021. Abu Dhabi was the best performer among GCC markets, gaining 68.2% for the year followed by Saudi Arabia with yearly gains of 29.8%.

Market Performance & Key Metrics

Source: Refinitiv

Source: Refinitiv

During December, Saudi equity market outperformed its peers, increasing 4.8% followed by Dubai equity market that increased by 4.0% in December. The outperformance of Saudi market is driven by its banking sector that soared on the back of mortgage boom attributed to country’s target of 70% home ownership among nationals. As the economy marks a strong rebound, there is also a marked increase in non-mortgage retail lending and corporate lending. Saudi Arabia’s banking sector released their interim financial results for Q3 2021, with net profit marking a 12% YoY growth for nine months ending September. Saudi’s largest banks – Al Rajhi and SNB witnessed an increase of 7.3% and 6.6% respectively in their share price, with a fall in provisions and a subsequent increase in net profits.

The Abu Dhabi market witnessed a drop this month, with its blue-chip stocks – Alpha Dhabi Holdings and First Abu Dhabi Bank decreasing 4.5% and 1.8% respectively over the month. Despite the drop, Abu Dhabi remains the top performing market within the GCC, with a return of 68.2% over the year.

Performance of S&P GCC Total Return Index

Source: Refinitiv

Source: Refinitiv

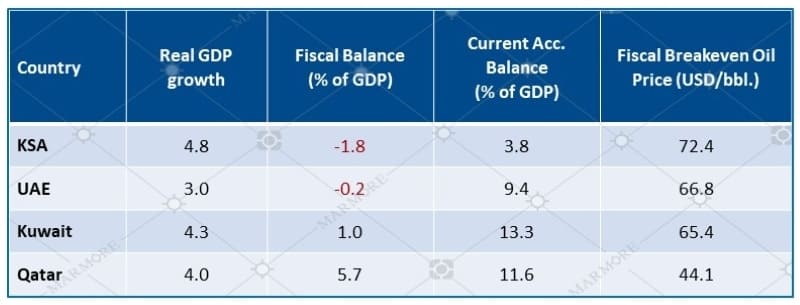

The outlook for UAE remains positive, with forecasts of its economy returning to pre-pandemic levels by Q1’2022. This comes from a combination of rising oil prices and increased production baseline, coupled with the boost in tourism sector, that accounts for 16% of its GDP, provided by the Dubai Expo 2020.

Key Economic Forecasts - 2022f (IMF Oct 2021)

Source: IMF

Source: IMF

Fitch Ratings upgraded Oman’s outlook to stable from negative. The upgrade comes from an increase in the oil prices, along with an improvement in key financial metrics such as government debt to GDP ratio and the country’s budget deficit-to-GDP that decreased to 3.4% this year from 16.4% in the prior year.

Know more about the performance of GCC and Global markets in December in our recent Global & GCC Capital Markets Review. Read more

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More