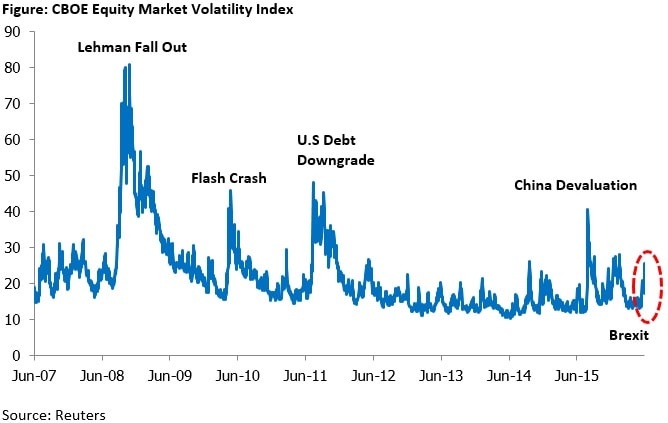

In order to assess the significance of Brexit event we compare the equity volatility levels over the years. As seen in the figure, the equity volatility index implies an anxiety level that is much lower than the ones witnessed recently such as Chinese yen devaluation or the scare in February, 2016 when U.S Fed announced they wouldn’t rule out negative interest rates after Bank of Japan introduced negative rates.

Impact on GCC’s Economy

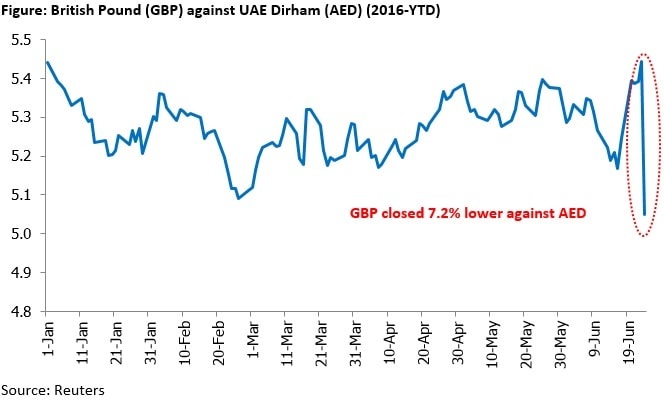

Britain exit from European Union has added an element of uncertainty that could further dampen global economic growth by delaying capital expenditures and sapping global consumer confidence. Impact on oil would be minimal since Britain consumes only 1.6% of global consumption and ranks 15 among global consumers. The more serious impact would be if there is contagion to the rest of the European Union. Further, as capital shifts into safe haven assets such as U.S treasuries, it would lead to further strengthening of U.S dollar. . Stronger U.S dollar would make imports from Britain cheaper as most of the GCC currencies are pegged to U.S dollar. GCC imports a lot of luxury cars from UK manufacturers such as Bentley, Aston Martin etc. which would all become cheaper. Capital equipment imports from Britain for other sectors such as telecom, power etc. would also become cheaper.

The uncertainty caused by Brexit outcome would act as a headwind to global growth, particularly in the U.S, and as a result U.S Fed could delay increasing their interest rates. Lower interest rates for longer bodes well for GCC economies as it helps to revive their economies which are bruised by the fall in oil prices. GCC governments could act swiftly to raise capital from international bonds before the rates start rising again.

Protectionist policy to the fore

One of the important implications of the vote is that the positive effects of globalization have not trickled down to all. The growing inequality as a result of stagnating incomes, especially for low skilled workers, due to technological advances resulting in plateauing of labour productivity has led to displeasures among the voting majority. They largely feel threatened by trade and immigration policies and fear their jobs are either being replaced by immigrants or outsourced to people in emerging countries. Backlash on globalization doesn’t bode for emerging markets and in particular GCC economies as they have largely benefitted from free flow of capital, labour and goods.

Impact on GCC's Investments in British Real Estate

Realty agents and analysts opine the exit from EU would end the housing boom in Britain bringing the price rises to an abrupt halt. Realty transactions are bound to be thin as buyers would prefer to ‘wait and watch’. Commercial real estate, especially office spaces, would be hit as multinational organizations reassess their strategy to stay in London, which so far had served as a gateway for EU markets. It is estimated that over 100,000 jobs could be relocated out of London and as a result office rents could drop by as much as 18% in the next two years (Jefferies (Mike Prew), sourced from Financial Times).

Sovereign Wealth Funds (SWFs) and HNIs in GCC are known to invest heavily in London's real estate. For instance, Investors from the UAE accounted for more than 20% of buy-to-let property sales in the UK in 2015. Qatar Investment Authority (QIA) is among the high-profile investors in London real estate, snapping up landmarks such as the Shard skyscraper, Harrods department store and Olympic Village (Reuters). Value of their holdings would be marked down due to the fall in pound value. The ensuing uncertainty would lead to investors demanding a premium, subsequently, the prices could further decline.

On the other hand, a steep fall in real estate prices in Britain (especially London) may also see fresh investments from GCC into the country on account of bottom fishing.

Impact on Trade with GCC

GCC region has been in talks with EU region for over 25 years and the Free Trade Agreement (FTA) between the regions is still pending. Having lost of access to EU, Britain to sustain its exports would be aggressive to sign bilateral trade deals. This presents an opportunity for GCC regions, especially Dubai, as it acts as a trading hub for MENA region as well as a gateway for African continent. Establishing bilateral trading agreement with Britain would be possible and this is a positive for GCC economies

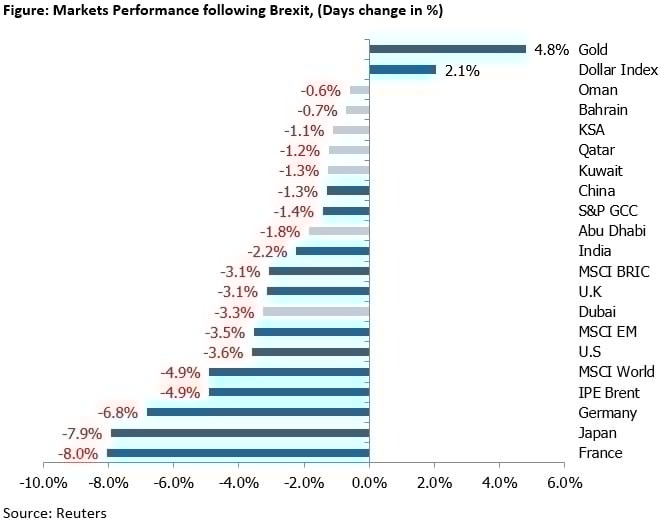

Impact on GCC Equities

GCC equities may continue to fall in the short-term, in line with global trends, as risk aversion engulfs investor sentiments. However, we feel the direct impact of Brexit is minimal on GCC equities as their earnings prospects are little affected by the event. As a result, we expect equities to gradually recover as their movements are largely dictated by domestic factors and oil prices.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

Kuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More