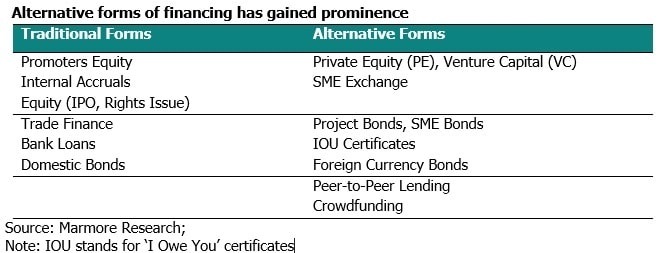

However, the current low oil price environment has transformed the financing landscape in the region as traditional methods of financing such as bank loans are being fast replaced with alternatives such as bonds, private equity, crowdsourcing and IOU’s.

The report added that budgetary deficits have forced the government to fix their deficits through debt issuance in both the domestic and international markets. The sudden spurt in debt issuance by the government and its related entities might be overwhelming for the domestic financial markets as evidenced by the spurt in short-term banking rates. Domestic banks that enjoy support from the governments have also been affected as the deposit mobilization process has slowed down. Subscription of domestic bonds issued by the governments has constrained the ability of banks to extend credit facilities as the loans-to-deposit ratio for banks across the region has reached the stipulated limits. Consequently, the banks themselves are issuing bonds to increase their capital ahead of various upcoming regulatory requirements. Though, the banks are well capitalized they may not be able to act as the dominant source of funding avenue.

In the case of Qatar, Oman and UAE where the loan-to-deposit ratio is much higher than 100% it would be difficult for banks to subscribe to state debt. They could take on government debt only at the expense of private credit growth. While government debt offers attractive yields, longer-term sovereign exposures which carries zero-risk weighting under Basel rules, higher sovereign issuances would crowd out borrowing space for private credits. Additionally, such measures would usurp liquidity in the system and lead to increased costs of funds in the money market. Interbank rates have already risen sharply as a consequence of it.

GCC countries, though comparable to most of the developed world in many aspects, fall short when it comes to the development of financial markets. The year 2015 saw the dampening of optimism and lower appetite for IPOs in the GCC countries as compared to the year 2014. There were only 6 IPOs in 2015 in the GCC region as compared to 1,144 IPOs globally in 2015 and 16 IPOs in GCC region, a year ago. This is largely attributed to the fall in price of oil which started in the second half of 2014. This led to a decrease in investor confidence and many IPOs were cancelled.

Private equity in the region is still at a nascent stage, though it showed some good progress between 2002 and 2008, the onset of global financial crisis stalled the growth of the industry. Private equity investments in the GCC region have been subdued since then with single digit fund closures in the last five years. PE funds raised in the region have declined by 78% during 2015 and the number of deals fell by 81%.

Issuance of corporate bonds (including sukuks) in the GCC are also largely restricted to the bigger companies. The absence of secondary markets for bonds further acts as a deterrant in the region. SMEs consistently face a hurdle in their effort to access finance. In 2016, it was estimated that there was close to USD 26bn gap in funding SME’s. Credit penetration to SMEs as measured in the form of bank loans provided to SMEs is among the world’s lowest for the GCC countries. It hovers around 2% as compared to 26% in OECD countries and 14% in non-GCC MENA countries, according to World Bank.

Other financing forms such as project bonds have gained prominence. A project bond is one that is associated with a particular project of the company and not the overall operations. Generally, these project bonds offer long-term investors attractive yields and significant credit spreads coupled with the security of the underlying asset. The bond’s proceeds are used to provide limited recourse, or non-recourse, financing to a single-purpose vehicle that owns, develops and builds a project. Ruwais Power Company issued project bonds in 2013, which set the precedence for project bonds in the power sector in the region.

In recent times, Saudi Arabia has toyed with the idea of issuing I-Owe-YoU certificate (IOUs) to pay for its outstanding bills with contractors and to conserve its cash reserves. KSA government owes approximately USD 40bn to country’s contractors and could issues IOUs in lieu of cash, which the contractors have the option to sell it to the banks or hold on until maturity.

Government’s in the region could also use the current economic scenario to move to a policy that brings in more private sector participation in the fund raising activities. SME Exchange is also being looked as an option to address the capital needs and fuel their growth. Peer-to-peer lending and crowdfunding platforms, though at a nascent stage, are making rapid strides in the region especially for SMEs (Small and Medium Enterprises) and start-ups by filling the gap left by conventional lenders.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

Kuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More