Global stocks staged a quick recovery from the March lows

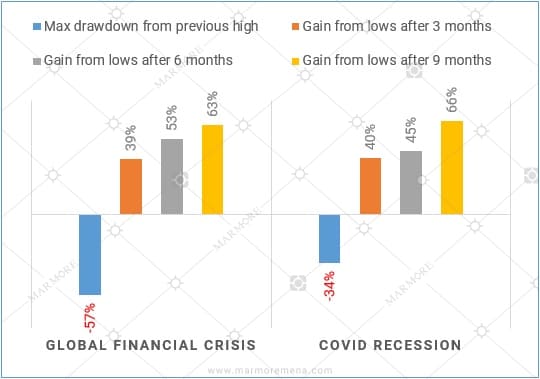

The year began with global stock markets reaching new highs in February. However, global markets saw massive falls in March as the COVID-19 outbreak became a global pandemic. At its lowest point in March, the S&P 500 saw a drawdown of 34% from the record highs seen just a month earlier in February. However, the index recovered the losses and reached new highs by October in a mere time span of seven months.

In contrast, during the 2007-2009 recession, the S&P 500 fell from then record high of 1,565 in October 2007 to 677 in February 2009 (drawdown of 57%). The markets took a long time to find a bottom level and the following recovery was also slow. It took nearly five and half years for S&P 500 to regain the lost ground.

Exhibit 1: S&P 500 performance during the last two recessions

Source: Refinitiv

Ad: Marmore Research Report

Unprecedented Monetary Easing by Central Banks & Fiscal Stimulus by governments

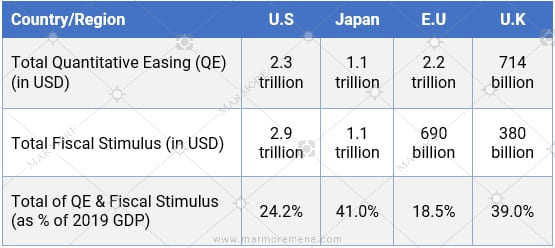

However this time, swift action by central banks and governments around the world and medical breakthroughs helped in the dramatic turnaround. The U.S. Federal Reserve, Bank of England, Bank of Japan and the European Central Bank have collectively spent USD 5.6trillion this year on quantitative easing, according to Bloomberg Economics. Central Banks have used tools like interest rate cuts and massive purchases of public and private debt to pump money into the financial system. These actions have stabilized financial markets and supported economic growth.

The U.S Federal Reserve announced an emergency rate cut of 50 bps on March 3 and another 100bps rate cut on March 15 reducing rates close to zero. The Bank of England announced an unscheduled rate cut of 65 bps on March 11.

Besides monetary measures, global governments also implemented massive fiscal measures. The U.S Government passed two COVID-19 bills totaling USD 2.9trillion in expenditure. The EU announced USD 640billion in direct spending to combat the pandemic’s effects. While, Japan has spent USD 1.06trillion in fiscal stimulus.

Exhibit 2: Fiscal and Monetary stimulus by governments

Source: Reuters, FT, Bloomberg, BBC

Source: Reuters, FT, Bloomberg, BBC

The article is an excerpt from our “GCC Capital Markets Annual Review: 2020” report. Read more

Ad: Marmore Research Report

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

Kuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More