COVID-19’s direct and indirect impact on GCC banking sector

Marmore Team

11 May 2020

The Current economic crisis due to the COVID-19 pandemic is likely to impact many sectors, none more so than Banking. The Banking sector will be directly impacted by lower profitability, increased non-performing loans (NPLs), deterioration in capital adequacy, etc. and also indirectly impacted by the effect of the various lockdowns and restrictions on the other sectors to which GCC banks are exposed which would impact their operations and profitability in the long run.

Direct Impact due to COVID-19

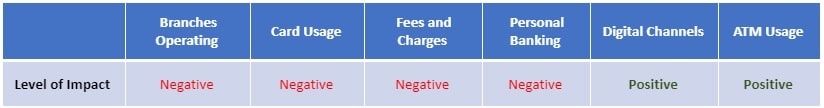

The operations of GCC banks have been hit due to limited branches operating and increased adoption of digital channels. The suspension of travel, hospitality, and leisure activities will see a decrease in credit card usage though increase in online purchases could make up for it to some extent. ATM usage is likely to go up as customers eschew bank visits. As mandated by regulators, GCC banks have waived processing fees and charges for certain transactions. Mortgage and personal financing will see a hit due to changing consumer behaviour during the lockdowns. Banks will need to review their existing processes and increase digitization and automation.

Exhibit: Operational Impact on GCC Banks due to coronavirus

Source: IMF; Marmore Research.

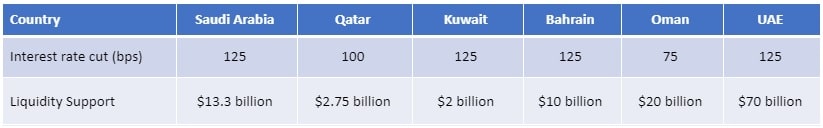

The direct financial impact will be a reduction in profitability due to lower Net Interest Margins (NIM) and higher provisioning for bad loans. The sizable cut in interest rates by all the GCC central banks since the start of the crisis will reduce NIMs since the gross yields earned on loans will decline more than the interest paid on deposits, and also the rate cut is unlikely to significantly increase credit volumes in the difficult environment right now. The sharp fall in oil prices and reduced activity due to COVID-19 will exert significant pressure on the real estate, trade, retail, transportation, and hospitality sectors. High provisioning for interest and loan exposures to several of these large business segments of the banks will result in losses for the banking sector which are likely to peak in the second quarter of 2020 and will also result in losses for the full year of 2020.

Exhibit: Monetary policy action by GCC Central Banks in response to COVID-19

Source: IMF, Central Banks.

Indirect Impact due to exposure to vulnerable sectors

The GCC economy has been hit by the double whammy of low oil prices and the coronavirus which has led to the shutdown of much of the non-oil economy. GCC Banks have the highest exposure to the real estate sector which is hit by falling prices and rents as new capacity continues to be added to already over-supplied markets. The Share of Real estate loans out of the overall loan book is Kuwait (28%), Qatar (27%), and UAE (29%) banks. In the case of UAE, any disruption to Dubai Expo 2020 which is already postponed, would impact its banking sector. Many GCC banks are exposed to Dubai Expo 2020-related projects in infrastructure, real estate, and construction segments. UAE banks are also exposed to NMC Health Plc to the tune of USD 2 billion, though its troubles preceded the COVID-19 crisis. The closure of hotels and shopping malls has significantly impacted the hospitality and retail sector. Various GCC governments have announced relief packages like postponement of principal and interest payment for 3-6 months for these affected sectors. While these measures could provide short-term relief, they may simply delay the recognition of impaired loans and understate the real extent of problem loans. Cash-flow generation by corporates will slow down leading to loan restructuring in the coming quarters.

Exhibit: Banking sector soundness in the GCC (in percent)

Source: IMF; Marmore Research.

Capacity of GCC banks to absorb losses

Most GCC banking systems have adequate capital buffers to absorb unexpected losses compared to the Global Financial Crisis in 2008(refer table above). According to S&P Global Ratings, GCC banks could absorb up to a $36 billion in losses before starting to deplete their capital base. Loan Loss Provision Coverage Ratio (LLP) has also improved for GCC banks since 2008 with Kuwait Banks having a LLP of 230% for 2019. Further, the GCC central banks have acted swiftly and relaxed capital adequacy and liquidity requirements in anticipation of rising bad loans in the coming months. Most banking systems also benefit from a high to very high likelihood of government support if needed. The fall in Oil prices has impacted the extent of the government support which is possible and the respective sovereign credit rating. On this basis, Bahrain (rated BB- by Fitch) and Oman (rated BB by Fitch) are most vulnerable due to their below investment-grade sovereign credit ratings. Kuwait, UAE and Qatar are best placed due to their higher sovereign rating (rated AA by Fitch ratings).

Conclusion

The GCC banking sector is expected to see significant operational and financial impacts directly as a result of lockdowns and indirectly due to the stress in the wider economy. On the operational front, this will result in adoption of digital channels which are likely to continue even after the crisis ends and change the face of banking. On the financial front, due to adequate capital buffers and the possibility of government support, the current crisis is expected to remain more of a profitability shock rather than a capital or solvency issue for GCC banks.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More