Liquidity is at the backbone of any market development and GCC stock markets are no exception. Strong oil price backed wealth effect coupled with retail nature of the market triggering speculative activity contributed to very robust liquidity levels in the past, especially before the financial crisis. Liquidity is generally measured as total value traded and is expressed as a % of total market capitalization to arrive at the velocity. A high velocity may indicate that liquidity is running ahead of the market and vice versa. Also, improved liquidity has many benefits including cost of transaction. In the context of GCC stock markets, the following questions beg answers:

– By how much did the liquidity drop for key index movers measured in terms of before and after Global Financial Crisis?

– What impact such a drop had on the bid-ask spread (a proxy to measure transaction cost)

– Are there any inconsistencies in this and if so what can explain it?

Before we answer these questions, let us quickly explain the methodology of this small research:

– We collected daily volume, value traded, market capitalization, bid-ask spread on 15 heavy weights in the GCC stock markets

– We organized this data in terms of pre financial crisis (before 2008) and post financial crisis (after 2008).

– We calculated Average Daily Value Traded (ADVT), a measure of liquidity for all the stocks

– We also calculated the Turnover ratio (defined as total volume traded/number of outstanding shares).

Now let us turn to our findings in a quest to answer our questions:

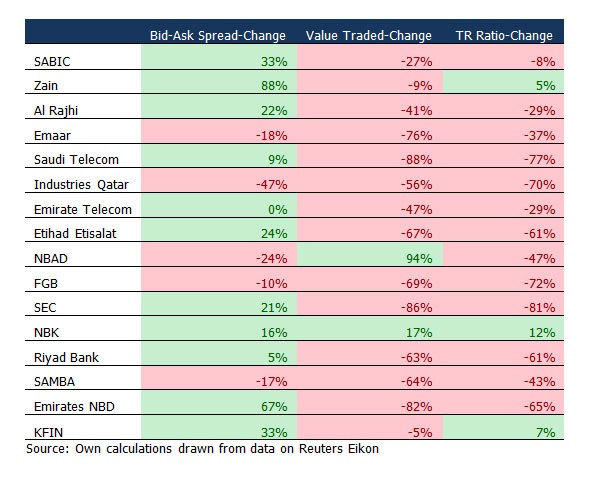

Table 1- % change between Pre-crisis (2003-2008) and Post crisis (2009-2013)

- By how much did the liquidity drop for key index movers measured in terms of before and after Global Financial Crisis?

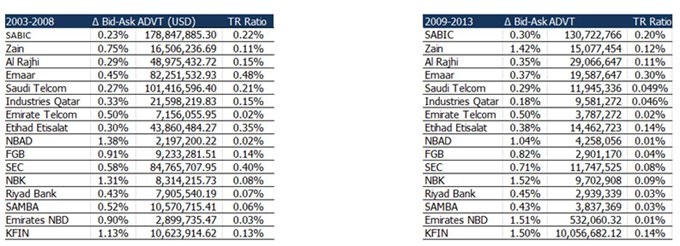

Regarding the first question liquidity dropped across the board in the aftermath of the crisis as expected. For example SABIC’s daily average value traded (ADVT) stood at USD 178 mn dollars during the period from 2003-2008. Post 2008 the ADVT fell by 27% to USD 130 mn dollars. Saudi Telecom saw a large decline in ADVT from USD 100 mn before the crisis to USD 11.9 mn a drop of almost 90%. The table above shows the effects of the crisis on the average value traded.

- What impact such a drop had on the bid-ask spread (a proxy to measure transaction cost)

In general, as liquidity improves, bid-ask spread reduces thereby reducing the cost of transaction. In the case of heavy weight GCC stocks, spreads increased in response to a fall in the liquidity for most of them. SABIC’s Spread was 0.23% prior to the financial crisis while after the crisis it increased to 0.3%. In the case of Saudi Telecom the Spread increased marginally from 0.27% to 0.29%. The biggest increase in spreads is seen in Zain where before the crisis the spread was around 0.75% (high compared to Saudi companies) while after the crisis it increased by 88% to 1.42% though this cannot be totally attributed to a fall in ADVT as ADVT declined only by 9% compared to pre-crisis numbers

- Are there any inconsistencies in this and if so what can explain it?

Finally were there any inconsistencies? Some companies in our study showed positive correlation in that while liquidity decreased, the bid-ask spread also decreased and vice versa. Examples include Emaar, First Gulf Bank and industries Qatar. However the main reason behind this positive correlation is that the mentioned companies did not have sufficient history for us to make meaningful comparison between pre-crisis and post crisis numbers. The only company with sufficient data was SAMBA and we could attribute the fall in liquidity to the financial crisis and attribute the fall in spread to peers. In other words, before the crisis SAMBA had the highest spread among Saudi banks under our coverage thus the number after the crisis had to drop to be in line with other Saudi banks.

Concluding Thoughts:

Leading GCC stocks today have more bid-ask spread than a few years before thanks to poor liquidity. The bid-ask spread ranges from a low of 0.18% (Industries Qatar) to 1.52% (National Bank of Kuwait). Going forward, as liquidity improves, the bid-ask spread should reduce and may reach levels seen before the financial crisis. Market attractiveness to institutional investors can be significantly increased if liquidity improves and reduces the bid-ask spread.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More