UAE markets outperformed its GCC peers and remained resilient in November

Nitin Nimbalkar

15 December 2021

GCC markets were also down, as evidenced by the S&P GCC composite index, which fell 5.0% for November. Weakness in Oil prices derailed the rally of GCC markets barring the UAE, with the Abu Dhabi (8.7%) and Dubai (7.3%) indices remaining resilient due to reforms announced by the government. Saudi Arabia and Qatar equity indices fell 8.1% and 3.2% respectively, as Saudi markets were affected by the sharp cuts in oil prices.

rnMarket Performance & Key Metricsrn rnSource: Refinitiv; ADVT – Average Daily Value Traded, TTM – Trailing 12 months, FF Adj. Mkt. Cap. – Free Float Adjusted Market Capitalization

rnSource: Refinitiv; ADVT – Average Daily Value Traded, TTM – Trailing 12 months, FF Adj. Mkt. Cap. – Free Float Adjusted Market Capitalization

Dubai markets remained resilient despite the turbulence in oil markets as investors were enthused by the recent reforms undertaken by the government. Dubai unveiled plans to list utility company DEWA, which would be one among 10 government entities to be listed in the local stock exchange in the coming months. The move was followed by the decision to overhaul the board of the stock exchange.

rnThe Abu Dhabi Index has had one of the greatest performing years with YTD gains amounting to 69%. It has launched a derivatives market, where investors can trade in single equity futures of some of the bourse's companies. The exchange has also proposed a regulatory framework enabling the listing of special-purpose acquisition companies (SPACs).

rnPerformance of S&P GCC Total Return Indexrn rnSource: Refinitiv

rnSource: Refinitiv

The increase in oil prices during the third quarter enabled KSA to post a small surplus of SAR 6.7 billion in Q3 2021, the first since 2019.

rnRating agency Moody’s stated that the sovereign creditworthiness of GCC countries is expected to be stable in the upcoming 12 to 18 months due to supportive oil prices and higher production.

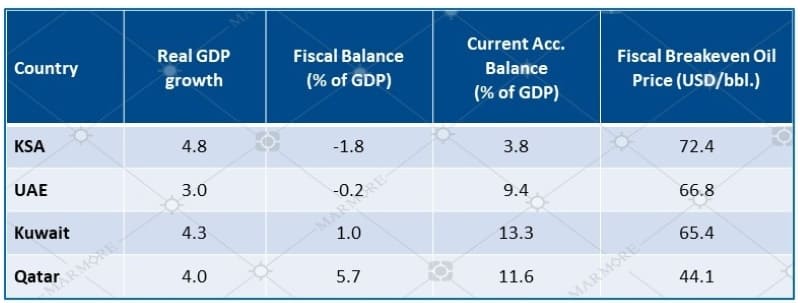

rnKey Economic Forecasts - 2022f (IMF Oct 2021)rn rnSource: IMF

rnSource: IMF

Among the GCC blue chip companies, the best performer was Emirates Telecommunications (Etisalat), which gained 24.8% during the month, followed by Abu Dhabi National Energy Company, which gained 14.6%. The rally in Etisalat was triggered by the positive Q3 2021 results in terms of revenue and subscriber base, which led to the company revising its guidance upwards for the full-year 2021.

rnrnKnow more about the performance of GCC and Global markets in November in our recent Global & GCC Capital Markets Review. Read more

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read MoreTags

No Tags!