Turkey has been making headlines these past few weeks due to the massive rate at which the Turkish currency, Lira, has been depreciating against the dollar. The economy is under stress with the International Monetary Fund (IMF) downgrading the growth forecasts from 7.1% in 2017 to 4.4% in 2018 and 4.0% in 2019. Inflation levels are reaching record highs to an annual rate of 15.9 percent in July with the Lira depreciating over 40% against the U.S dollar so far in 2018. The events unfolding in Turkey has an impact on the Gulf Cooperation Council (GCC) region through various channels in the form of bank exposures, bilateral investments, trade and tourism among others. It is important to take a closer look at how this event has impacted one of the closest ally and economic partner of Turkey.

Impact on GCC Banks

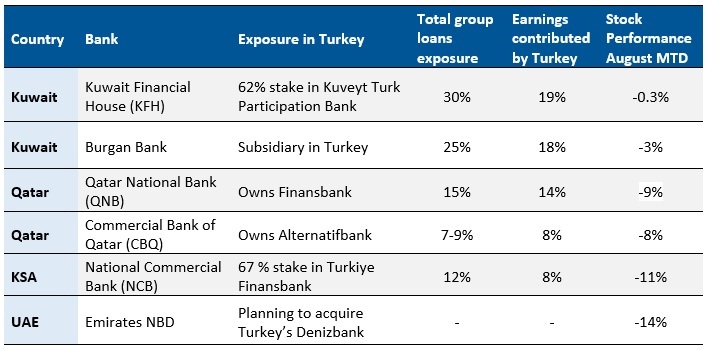

Multiple banks in the GCC region have exposures either directly or indirectly through their subsidiaries in Turkey. Amongst the GCC banks, Qatar National Bank (QNB), Commercial Bank of Qatar (CBQ), Burgan Bank, Kuwait Financial House (KFH) and National Commercial Bank (NCB) have all seen a significant impact in their share prices on the back of the lira’s depreciation.

GCC banking exposure to Turkey

Source: Reuters, Data as of Aug 21

QNB owns Turkish lender Finansbank, the fifth-largest privately owned bank by assets in Turkey, which it bought for €2.7 billion 2016 from National Bank of Greece. About 15 per cent of QNB’s assets and 13 per cent of its loans are linked to Turkey. CBQ, Qatar’s third largest bank by assets, owns Turkey’s Alternatifbank, has been deploying more capital and focus on its Turkey business in a bid to benefit from closer political ties between the two countries (Reuters). KFH, Kuwait’s second-biggest lender by assets has a sizeable business in Turkey with over 400 branches and has nearly 6,000 employees. Saudi Arabia’s National Commercial Bank (NCB) acquired a 67.03 percent stake in Turkiye Finansbank for $1.08 billion in 2007. Türkiye Finansbank has total assets of $5.6 billion.

As for the earnings impact, Turkish operations account for 19 per cent, 18 per cent and 14 per cent when it comes to KFH, Burgan Bank and QNB, respectively. It also contributes a sizable portion to CBQ and NCB amounting to 8 per cent for both the banks. KHF has the highest loan exposure to Turkey, nearly 30 per cent, followed by Burgan Bank, QNB and NCB with 20 per cent, 15 per cent and 12 per cent respectively. (Reuters, Shuaa capital)

Dubai’s biggest lender Emirates NBD agreed to buy Turkey’s Denizbank from Russia’s state-owned Sberbank for $3.2 billion with an aim to increase its outreach in the Middle East, North Africa and Turkey. The sharp fall in the Turkish lira since the announcement of the deal in May 2018, could trigger an adverse change in the clause creating the possibility for a renegotiation of the deal and a reduction of the acquisition price by as much as 25-30%. (Reuters)

Impact on Trade

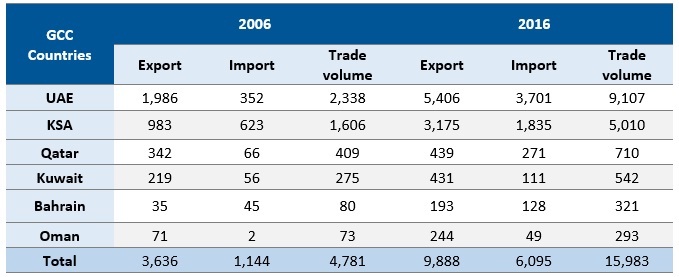

Over the past decade, Turkey and the GCC states have actively pursued closer economic ties that has taken their trade volume from $4.8 billion in 2006 to around $16 billion in 2016, a more than threefold increase.

Turkey-GCC bilateral trade (in USD)

Source: Based on data from the Turkish Statistical Institute, November 2017

The Turkish crisis has not caused any major damages to the GCC region when it comes to trade. GCC imports and exports from Turkey account for just 2% and 1.4% of its overall trade volume respectively. Turkey too has a modest level of trade with the various GCC countries, with exports and imports of 7 per cent and 3 per cent respectively. However, Turkey is a key destination for non-oil exports for the GCC region where UAE was the 13th largest source of imports into Turkey last year.

The main exports for the GCC countries to Turkey include consumer goods, intermediate goods, fuels, precious metals, plastic, rubber and chemicals and the major imports are Consumer goods, Glass, Metals, Capital goods, Machinery, Electronics, Textiles and Clothing. (World Bank). Overall, we do not expect to see any major impact on the trading volume between the two regions due to the limited trading activity.

Turkey imports oil majorly from Iraq, Iran and Russia which together account for over 80%. Among GCC countries, Kuwait and Saudi Arabia oil exports accounted for 10% and 8.5% of Turkish oil imports, respectively.

Impact on Tourism

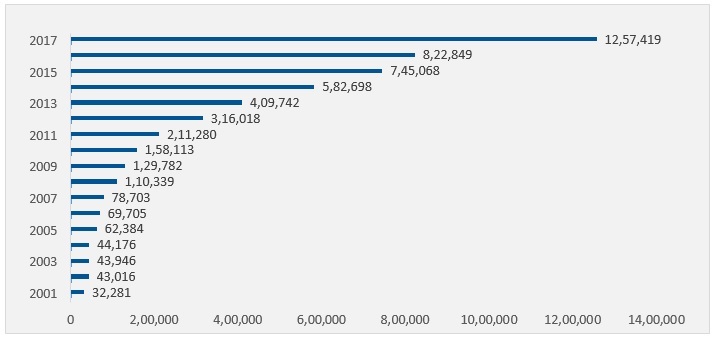

Turkey has been an attractive tourist destination for travelers from the GCC region due to its weather, presence of historic monuments and deep religious & cultural bonds. The number of tourist arrivals from the GCC region has increased by over 50% over the past 3 years in 2017 and the continued depreciation of Lira could encourage further tourists arrivals. On the other hand, the tourism industry of the GCC region would not be impacted, as people from Turkey do not constitute the main source of tourists.

Number of GCC citizens arriving in Turkey, 2001–2017

Source: Based on data from the Republic of Turkey Ministry of Culture and Tourism

Impact on Real Estate Investments

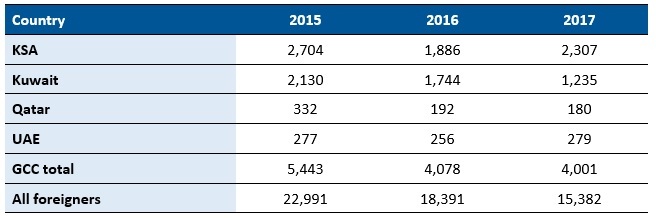

Gulf investors have been active in Turkey’s real estate market for a long time now. Acting as the gateway between Asia and Europe, Turkey has been successfully attracting Gulf nationals to its real estate sector. In 2012, Turkey changed the law to facilitate property investments by Gulf nationals, allowing them to buy properties by passports only and offering a one-year residency permit to foreign investors and their families. Other incentive introduced by the Turkish government includes the golden visa scheme. The government announced that it would grant citizenship to foreigners who buy property worth at least $1 million and invest a minimum of $2 million, or deposit at least $3 million in a bank account for more than three years.

Istanbul and Mediterranean coastal cities are popular with GCC investors due to their close links, both geographically and culturally. Over the past two years, GCC citizens have been among the most active participants in Turkey’s real estate market, with Saudis and Kuwaitis ranked 2nd and 3rd in houses sold to foreigners in Turkey in both 2016 and 2017. In fact, GCC citizens have purchased over one-fourth of all properties sold to foreigners in 2017. Kuwaiti foreign direct investments in Turkey are about $2 billion and the real estate sector accounts for 70 percent of the total. (OxGAPS Forum).

Number of houses sold in Turkey to GCC citizens

Source: Based on data from the Turkish Statistical Institute, November 2017

However, the continued depreciation of lira against U.S dollar has lowered the value of the investments. In 2018, Turkish Lira has lost approx. 40% of its value to USD implying that homes purchased for USD 1million a year back would now be valued USD 600,000. Though the perceived loss is notional, it exposes the investor to the vagaries of investing in emerging markets. The situation is exacerbated by strengthening dollar and rising interest rates, which generally portend capital outflows from emerging markets such as Turkey. Turkey could continue to face challenges unless policy credibility is restored and measures to boost market confidence are enacted.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More