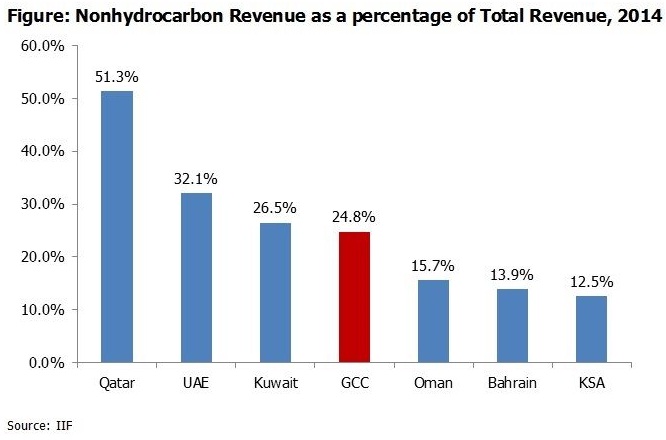

The Paris agreement establishes a new international context for countries’ use of fossil fuels, including limiting worldwide temperature rise to well below the two degrees Celsius mark and undertaking efforts to constrain the rise to 1.5 degrees Celsius over the long term (The Scottish Government). The climate change agreement is a reflection of a collective thought, particularly emanating from the advanced nations, that is trying to move towards a post-hydrocarbon energy era. What does this mean for the GCC, whose predominant source of income is hydrocarbons? The following graphic illustrates the contribution of nonhydrocarbon revenue as a percentage of total revenue.

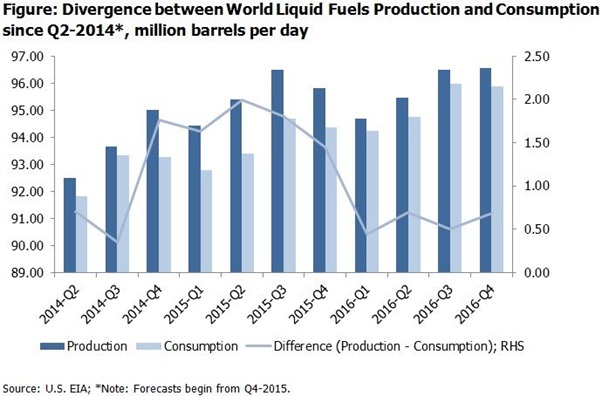

Meanwhile, the supply side of the oil equation is getting larger as well. On December 19, 2015, news emerged that the U.S. lifted a 40-year-old ban on export of American oil. Moreover, Iran, which anticipates removal of sanctions soon, has indicated that it would boost output by 500,000 barrels per day in a post-sanctions environment, which it expects sometime in early 2016. Thus, the oil glut appears to be getting wider by the day.

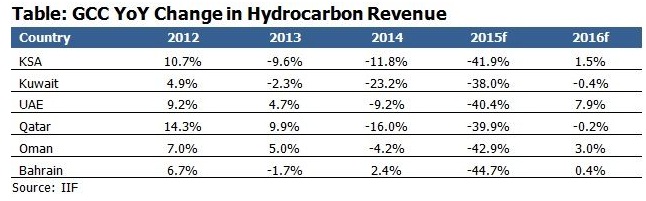

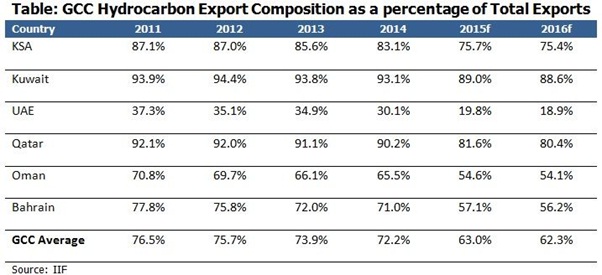

In conclusion, it can be said that if the GCC does not economically diversify and create new revenue sources, then the massive fiscal reserves too will come under immense stress over the long term. The Paris climate deal is one more reminder and catalyst for the urgent need for economic diversification in the GCC.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More