Kuwait stocks fell in November driven by sharp fall in oil prices

Marmore Team

09 December 2021

Kuwait, in line with the broader GCC market, ended the month in red, fuelled by sharp fall in oil prices. The growing fears over a new COVID-19 variant also led to profit taking at the end of the month.

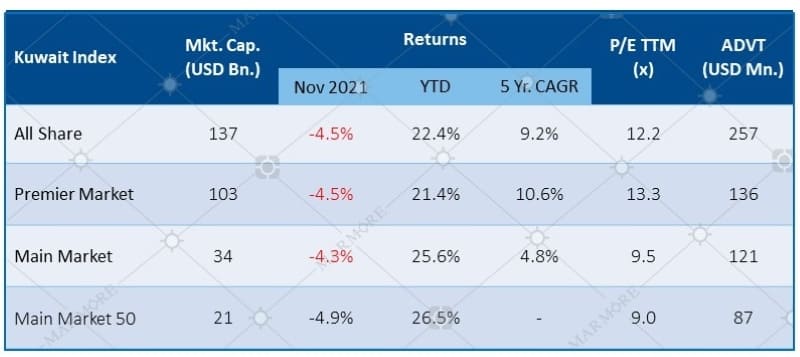

Market Performance & Key Metrics

Source: Refinitiv, Boursa Kuwait

Source: Refinitiv, Boursa Kuwait

All sectors, except Healthcare and Insurance, declined in November. Insurance was the top gainer, rising 7.6% followed by healthcare which recorded modest gains of 1.8%. Basic materials and Industrials sector indices registered the biggest decline, falling 10.4% and 7% respectively, for the month.

Sectoral Performance & Key Metrics

Source: Refinitiv, Boursa Kuwait

Source: Refinitiv, Boursa Kuwait

Kuwait recorded a deficit of KD 10.8 billion in FY 2020-21, an increase of 174.8%, which is the highest budget deficit in the country's history. In addition to this, the IMF has projected that Kuwait will record the highest non-oil budget deficit among GCC countries at 68.7% in 2021.

On a positive note, Kuwaiti Government agencies have achieved a savings of about 25% of the target for reduction of their expenditures in the current fiscal year budget. The budget deficit for the seven months of FY 2021-22 was lower than expected at KD 1.2 billion vs KD 3.8 billion for the seven months of FY 2020-21, owing to higher oil revenues on the back of increased oil prices.

Domestic credit in Kuwait had increased 4% YoY in 9M 2021 and was driven by an 11% increase in household credit in 9M 2021 vs 9M 2020. Corporate credit has been slow to recover as they still continue to be pressured by the effects of COVID along with factors like high levels of repayments/write offs hindering meaningful growth.

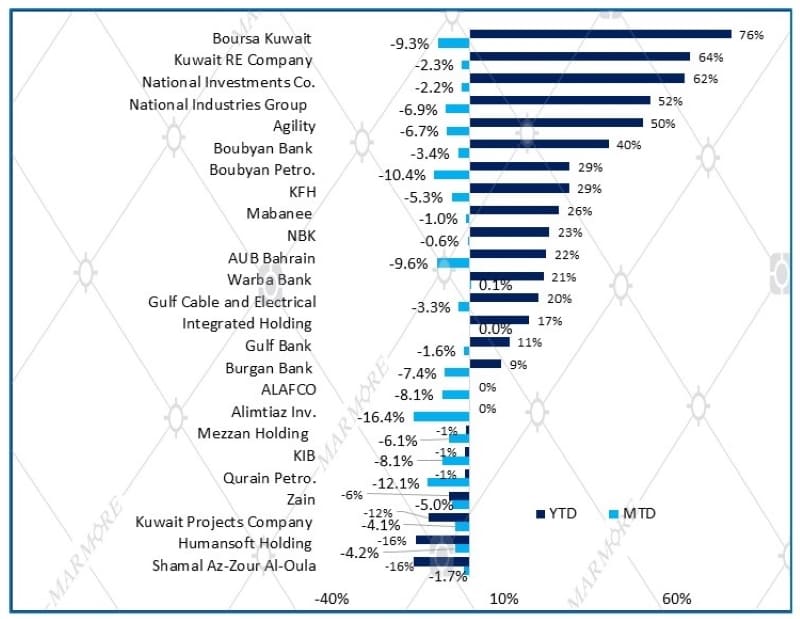

Most Premier market stocks were negative, with the exception of Warba Bank and Integrated Holding, which were flat during November. All listed banks have come out with their Q3 results with aggregate Net interest income in 9M 2021 surpassing the levels of 9M 2020 but are yet to reach pre COVID levels owing to the prevailing low interest rate environment.

Premier Market Stocks' Performance

Source: Refinitiv, Boursa Kuwait

Source: Refinitiv, Boursa Kuwait

Know more about the performance of GCC and Global markets in November in our recent Global & GCC Capital Markets Review. Read more

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More