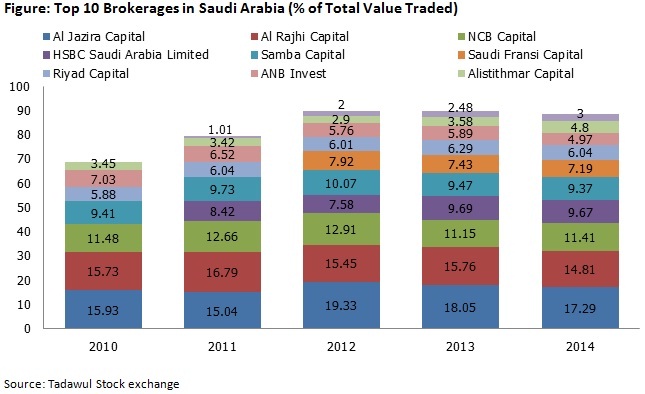

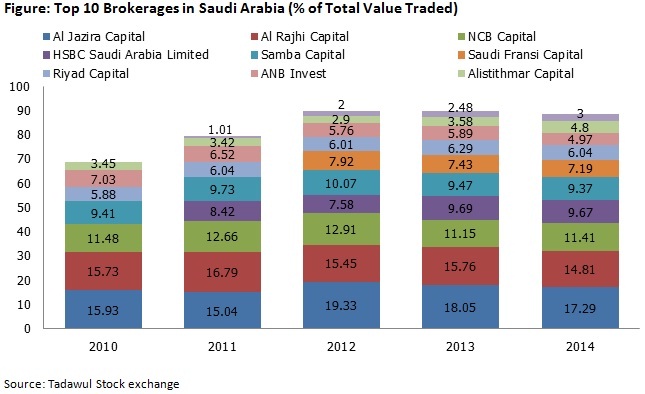

Saudi stock market is dominated by the top 10 brokerage firms contributing approximately 90% of the value traded. Some of the players who have ranked atop consistently in the Saudi Arabian market in terms of value traded as brokers include AlJazira Capital, Al Rajhi Financial Services Company, NCB Capital, Samba Capital and HSBC Saudi Arabia. The larger players (i.e.) brokerage divisions of the banks and other standalone players offer full services such as provision of single window for investing in the six GCC countries. Web and PC based trading platforms have been able to make long strides in KSA over the past few years primarily owing to their convenience.

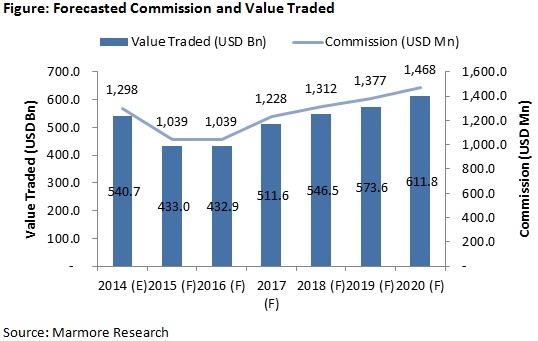

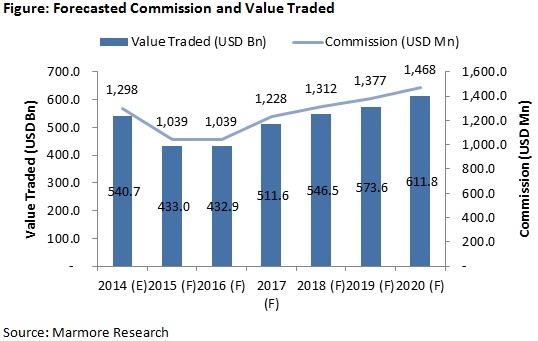

The Saudi Brokerage industry is regulated by Capital Market Authority (CMA). The CMA only specifies a minimum and maximum brokerage that can be charged by the brokers and offers the brokers the freedom of discounts on the commission in order to attract the clients. The commission charged by the brokerage firms in Saudi Arabia is set at maximum of 0.12% of the value traded by the stock exchange. Based on the value traded in 2014, the commission earned by the brokerage firms in 2014 was estimated at USD 1.29bn. The commission earned by the brokerage firms is estimated to increase at a CAGR of 2% between 2014 and 2020 to reach USD 1.46bn in 2020. Tadawul is likely to witness increase in volume traded in the coming years which is attributable to regulatory liberalization permitting foreign investors to own shares traded on exchange. However, similar to the investor’s response in 2015, the trading activity is expected to be lean during 2016 due to continued lower oil prices.

The brokerage firms in KSA are dependent on the buying and selling of equities for revenue generation. Absence or miniscule presence of other products such as ETFs, mutual funds, commodities and derivatives limit the opportunity of revenue generation from these products. Additionally, the restriction on short selling limits the potential for the brokerage firms to earn revenue from these transactions. Increasing the basket of products offered by the brokerage firms increases the revenue generation avenues. Additionally decreasing stock turnover, underdeveloped corporate governance regulations compared to developed markets and lack of institutional participation are some of the key challenges hindering the growth of the equity capital markets in Saudi Arabia and in turn impacting the brokerage industry’s revenue.

All brokerage firms provide research support; however, most of them have limited their offerings to periodic reports (daily, monthly or quarterly) and equity research reports. Since availability of information related to the stocks and industry is a major challenge, as only 49.7% (Marmore estimates) of the stocks listed on the Tadawul exchange are covered by the analysts. Brokerages firms may further enhance their research offering as presence of reliable information increases confidence of retail and institutional investors. This will result in increased participation of investors in the equity markets and ultimately benefitting the brokerage industry.

Strong IPO activity, a possible MSCI re-classification from standalone market to emerging market, Tadawul’s liberalization to let foreigners buy shares directly and CMA’s proactive strategy to build a stronger regulatory framework are some of the opportunities that the KSA brokerage industry is likely to benefit from.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's

Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More

How secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More

2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More

Tags

No Tags!

Share via

Downloads