KEY QUESTION 1: What are Basel III norms and why are they important for application in Islamic Banking?

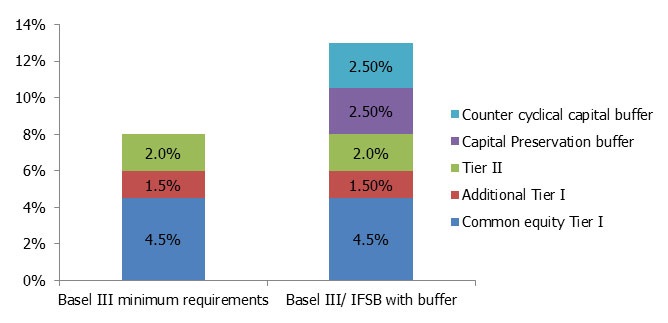

The Basel III norms were introduced after the 2008 crisis to make the banking system more robust. Under the norms, banks shall hold 6% of Tier-I capital and 2% of Tier II capital. Tier I capital includes 4.5% of common equity and 1.5% of additional Tier-I capital which includes preferred stock and hybrid securities.

Basel III norms are mandatory for all banks, including Islamic banks. This ensures that banks are well equipped to withstand financial shocks and maintain higher levels of liquidity to be prepared for uncertainties in the financial markets.

Islamic banks generally have low-profitability assets like cash and central bank deposits, and less of High Quality Liquid Assets (HQLA), which has a major impact on liquidity. The Islamic Financial Services Board (IFSB) has proposed a few guidelines to help financial institutions improve liquidity coverage ratio and improve HQLA.

KEY QUESTION 2: What are the capital requirements applicable to Islamic Banking and sukuks?

The IFSB that sets standards and principles for Financial Institutions offering Islamic Financial Services has proposed an additional 2.5% of capital conservation for Islamic banks as a buffer, in addition to the specified minimum capital of 6% under Tier-I and 2% under Tier-2 (totaling 8%). This is because products used by Islamic banks have high risk underlying physical assets such as real estate. The norms also state that banks should have a counter cyclical buffer of up to 2.5% of capital in case of excessive credit growth.

Islamic banks can have sukuks with a portion of additional Tier-I and Tier-II capital based on their assets. Sukuk is Arabic for financial certificates, but colloquially refers to the Islamic equivalent of bonds that are structured to comply with Sharia laws.

In this definition, Tier-I capital includes perpetual Sukuk or Musharaka, which is a joint enterprise or partnership structure based on profit sharing instead of interest-bearing loans. Mudaraba and Wakala have a maturity period of 5 years and can be classified under Tier-II capital. Mudaraba is a partnership where capital in cash or assets but the fund provider party provides no debt and the other party, also called the mudarib, provides labor. In a Wakala, depositors place funds with the bank to invest in suitable Shariah projects and the bank acts as agent to invest these funds into various assets.

Figure 1 : Capital requirements under Basel III/ IFSB standards

Source: Nomura Institute of Capital market research

KEY QUESTION 3: Why is it important to distinguish between conventional banks and Islamic banks for implementing Basel III norms?

The reason why these rules were put in place is that Islamic banks differ from conventional banks in terms of operations and risk profile. The same set of regulations of Basel III norms is currently applicable to both and this does not recognize the differences between the two types of banks. Two problems occur due to the differences.

First, the main source of funds for Islamic banking is from Profit Sharing Investment Accounts (PSIA). The capital adequacy ratios applied by Basel III norms do not consider the fact that a major portion of the risk is borne by the investors and not by banks.

Second, Islamic banks are prohibited from getting interest payments under Sharia Laws, which renders high level of liquidity risk on the assets as compared to conventional banks. Thus, the financial tools that involve interest under Basel III have limited applicability to Islamic banking.

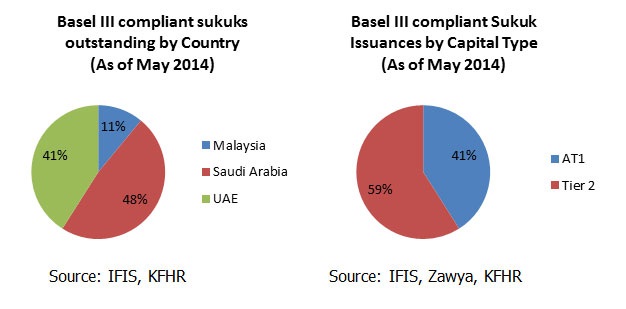

The “Basel III-compliant sukuk” was created to fulfill revised capital standards. The first Basel III-compliant sukuk was introduced by Abu Dhabi Islamic Bank (ADIB) in the UAE in November 2012, with a value of USD 1 billion. This was compliant with Basel III Additional Tier I capital (AT-1) requirements. The response by investors was overwhelming with the issue oversubscribed by 30 times. This success encouraged other banks across UAE, Saudi Arabia and Malaysia to issue sukuk instruments to improve AT-1 or Tier-2 capital. According to Rasameel Sukuk Report, July 2014, Ten Basel III compliant sukuks were issued until June 2014 with a value of close to USD 5 billion.

KEY QUESTION 4: What is the market structure of sukuks?

The largest market share of sukuks is held by Saudi Arabia, totaling 48% followed by UAE with 41% and Malaysian Islamic banks with 11% outstanding as of May 2014 (Figure 2). Malaysia has the largest market share in terms of outstanding sukuk volume, according to the Islamic Finance Information Service. However, Malaysian banks don’t really need to issue Basel III compliant sukuks. This is because, they have an advantage of being capitalized to the extent of sustaining a 300% increase in non-performing loans without Tier-I capital falling to below 7%.

Figure 2: Basel III compliant sukuks outstanding by Country and Capital Type (As of May 2014)

NBAD in the UAE managed the USD 1 billion perpetual sukuk issuance for Dubai Islamic Bank in January 2015, which was the first public regulatory Basel III compliant capital issuance. Qatar Islamic bank also suggested a plan to raise Basel III compliant Tier-1 capital worth QAR 2 billion to fuel construction of facilities for 2022 Football World Cup.

Out of the entire issue of Basel III compliant sukuks, 41% of volume raised supports Basel III AT1 capital and 59% volume raised supports Tier 2 requirements.

KEY QUESTION 5: What are the opportunities in the horizon for the sukuk market?

Several. Companies with high quality credit can utilize sukuks, which are issued at favorable terms by Islamic banks. Banks are likely to purchase sukuks issued by government entities as these would improve the quality of the bank’s capital being low risk bonds. Being a part of the definition of IFSB guidelines, sukuks are expected to increase credit quality of liquid assets. The UAE’s central bank has made provisions to accept sukuks as collateral for banks from April 2015, a move which other regulators are expected to follow suit. It is likely that issuers may start listing their instruments on the stock exchange.

Thus, Islamic banks are likely to be encouraged to issue more Basel III compliant sukuks in the near future with the strengthening of capital requirements and liquidity needs under Basel III norms and IFSB regulations.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More