GCC liquidity squeeze could spur reforms: MR Raghu – Low oil prices could result in deficit of 7.9% of GDP in 2015

Marmore Team

29 November 2015

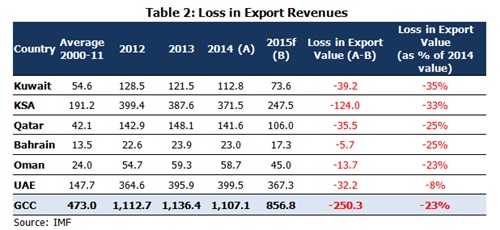

Raghu added that GCC countries continue to be heavily reliant on hydrocarbon revenues, despite their diversification efforts. IMF expects oil export revenues for GCC countries to decline by $250 bn in 2015 from 2014 levels. With the current oil price being lower than the breakeven oil prices, fiscal surplus of GCC countries which stood at 4.6 percent of GDP in 2014 is expected to turn into deficit to the tune of 7.9 percent of GDP in 2015. Though the GCC governments had largely retained their budgetary spending in 2015, thus sustaining economic growth in the medium term, fiscal reforms are imperative.

He noted that with the fiscal situation amid the low oil price environment drastically changed the GCC governments may have to reassess their spending patterns. However, the low debt levels of the GCC countries, which stand at 9 percent of GDP as against 117 percent of GDP for G7 nations coupled with higher sovereign ratings for most GCC countries, lend comfort in the short-term.

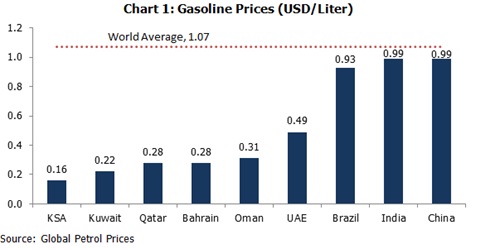

With most international organizations such as IMF, World Bank and leading investment banks (JP Morgan & Goldman Sachs) expecting the lower oil price environment to persist, GCC governments have been drawing multiple strategies to plug the deficit, including liquidating their stakes held through Sovereign Wealth Funds. Saudi Arabia has already withdrawn over $70 bn of its reserves in the past year. Additionally, governments across the GCC region have cut-back on non-priority spending and are working on tackling the increasing subsidy problem.

Raghu added that the impact of lower oil revenues has visibly impacted the deposit mobilization process in GCC banks, as government deposits account for sizeable portion. Fall in deposits growth coupled with governments drawing down on their savings has led to short-term pressures on the money market. Though the banks are well capitalized, they may not be able to act as the sole source of funding avenue for the governments.

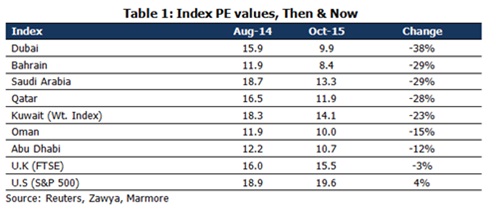

Equity markets have fallen over the last year in line with the drop in crude oil prices. With GCC corporate earnings expected to be muted in the near term, and declining bank lending to invest in the equity markets, stocks in the GCC may face continued pressure. Indeed, the valuation of GCC markets as measured by P/E multiple has on an average declined by 25 percent, since Q2, 2014. International bond issues from the GCC countries (corporate and sovereign) have dropped 33 percent from a year earlier to $ 22 billion in the first nine months of 2015 which is the lowest 9-month total since 2008.

Additional funding routes such as local and international debt markets could be tapped. KSA for the first time in last eight years raised debt to the tune of $27 bn in local debt market. Revenue augmentation measures such as introduction of Value Added Tax (VAT) across GCC is being widely discussed. On the other hand, IMF has been advocating introduction of taxes in a phased manner.

While the record low interest rates, higher sovereign ratings, low debt levels and higher opportunity cost for Sovereign Wealth Funds (SWFs) argue for the case to raise debt to plug the deficit rather than liquidating SWF assets, the actions of GCC government and its impact on the financial system at large, will be closely watched in the coming months, opined Raghu. Continued pressure on liquidity will accelerate long awaited reforms in the GCC region which augurs well for the long-tem

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More