Spurred by high oil revenues, credit growth and economic diversification, real GDP growth rates in the GCC countries have been high in international comparison. They have been comparable to those of other emerging and developing markets and considerably higher than those of the world or the advanced economies on average. Together with growth in intra-GCC trade in the wake of the GCC customs union, this will lead to increased demand for financial services. This book explains these aspects and challenges of GCC financial markets. As financial markets often witness rapid change they are a moving target to study.

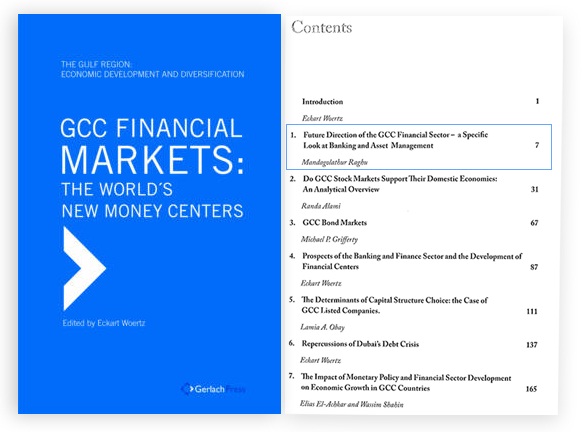

Mandagolathur Raghu of Kuwait Financial Center (Markaz) gives an outline of the various segments of the GCC financial sector and relates them to macroeconomic figures such as GDP growth, money supply, fiscal balance and inflation. He gives particular attention to asset management practices and the structure of the banking sector and identifies areas where further institutionalization and professionalization are needed.

For more info on the article, kindly click on the link below:

http://www.gerlach-press.de/

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read MoreTags

No Tags!