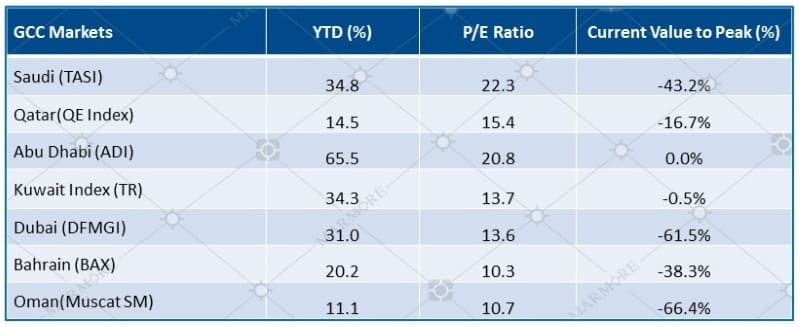

The GCC Equity markets like the rest of the major world markets have been having a stellar run in 2021. Until November 21st the S & P GCC Composite Index has generated Year-to-Date (YTD) return of 35.6%, which has not been seen for many years in these markets. Valuation-wise, GCC composite index trades at P/E ratio of 23.3 and the current index value is still at a discount of 47.4% compared to its historical peak value. The performance of the individual markets is as given below:

Source: Refinitiv; Note: Data as of Nov 20, 2021 close

Source: Refinitiv; Note: Data as of Nov 20, 2021 close

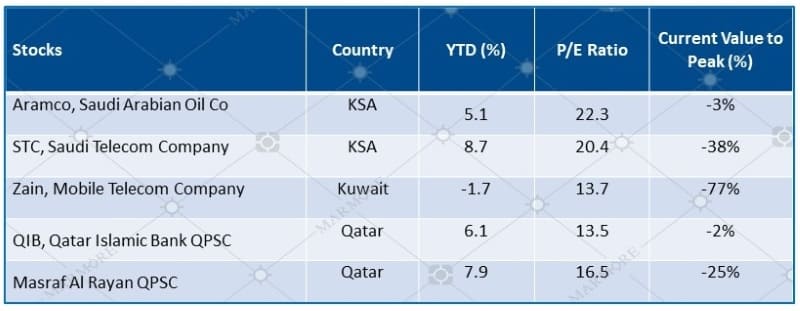

All the markets except for Qatar and Oman to a lesser extent have given high YTD returns. All the markets except Abu Dhabi and Kuwait are still much below their peak value. However, despite the overall Bull Run in these markets, some of the blue chips have not participated in the rally and remain surprising laggards. These include the following:

Source: Refinitiv; Note: Data as of Nov 20, 2021 close

Source: Refinitiv; Note: Data as of Nov 20, 2021 close

There could be different reasons for different blue chips concerning their below market performance during the year. In the case of Saudi Aramco, its value is near its all-time peak and its P/E Ratio is at the market average though it is a behemoth in the market both of which may be putting a cap to further appreciation in value that can be expected during the current period. In the case of Saudi Telecom Company its P/E Ratio is below that of the market, but it is to be noted that its business in 2020 fared well despite COVID-19 and the share price did not therefore fall significantly in 2020 like the broader index shares thus providing a relatively higher baseline for 2021.

Mobile Telecommunications Company, Kuwait has been a laggard but then its PE Ratio is at the same level as that for the Kuwaiti market and its business performance in 2021 was below that in 2020 due to lower revenues caused by currency devaluation that adversely affected Sudan and Iraq operations coupled with Covid-19 impact that continued for some of its operations, which may be possibly limiting immediate potential for further gains. Qatar Islamic Bank clocked high 15% returns in 2020 and is at a P/E Ratio close to that of the market but more importantly a possible explanation for its sub-market performance in 2021 may be its price being close to the peak price that will require a performance impetus to push its price higher. Masraf Al Rayan clocked high 21% returns in 2020, has lack luster growth in 2021 and has a P/E Ratio above that of the Qatar market indicating an already premium valuation for the company that possibly caps potential for large appreciation during 2021. All in all, some of the blue chips have remained market laggards in 2021, but it remains to be seen whether they will win market fancy in coming quarters.