Biggest & Fastest Wealth Creators in GCC (2012-2021) Surprisingly it is not a static list

Marmore Team

04 April 2022

Source: Refinitiv; Marmore Research

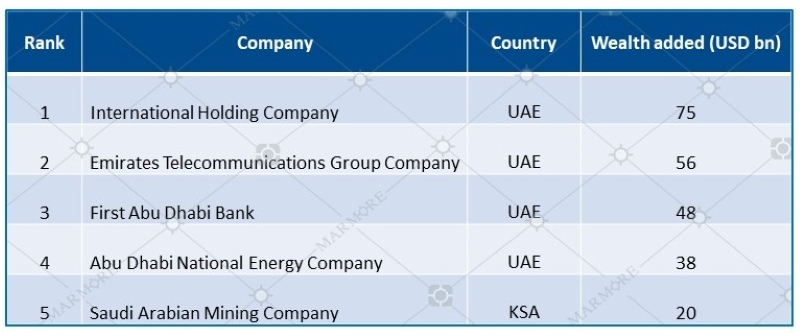

The biggest wealth creator in terms of market capitalization during the last decade International Holding Company listed in Abu Dhabi Stock Exchange. The company created $75 billion of wealth since its listing in 2005, followed by Emirates Telecommunication Group Company ($56 billion). The first four of the top five wealth creators are Abu Dhabi-based whereas the fifth one is based out of Saudi Arabia.

Top five Fastest Wealth Creators (FY 2012-21)

Source: Refinitiv; Marmore Research

The biggest wealth creator in terms of market capitalization during the last decade International Holding Company listed in Abu Dhabi Stock Exchange. The company created $75 billion of wealth since its listing in 2005, followed by Emirates Telecommunication Group Company ($56 billion). The first four of the top five wealth creators are Abu Dhabi-based whereas the fifth one is based out of Saudi Arabia.

Top five Fastest Wealth Creators (FY 2012-21)

Source: Refinitiv; Marmore Research

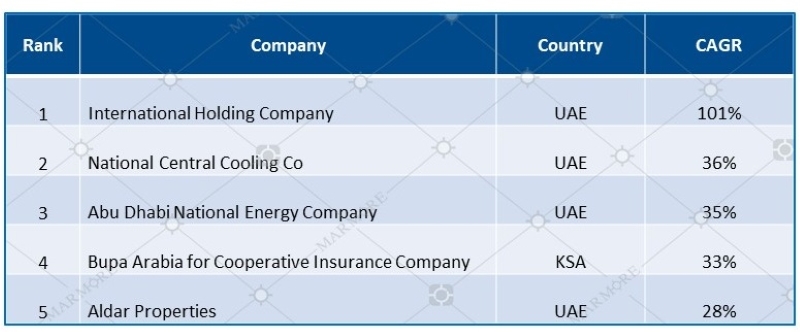

The fastest wealth creator in terms of annual growth rate of total return is also Abu Dhabi listed International Holding Company with CAGR of 101% which is more than 10x higher compared to the S&P GCC Composite Index with a CAGR of 10%. The International Holding Company created wealth at a slow pace for the first five years 2012-16 and then it added its wealth enormously with a CAGR of 210% in the last five years 2017-21. The shares have been increasing from 2019, when it was trading at ~AED 1 (its current share price is ~AED 190). The various acquisitions made since the start of 2019 seem to have contributed to the surge in share prices.

If the period is further broken into two five-year periods (2012-16 & 2017-22), major changes are observed in wealth-creating companies and sector performances. The wealth creators of 2012-16 are entirely swapped with a new set of companies in 2017-21. The wealth created in 2017-21 by these companies exceeded three times the wealth created in 2012-16. The number of companies in the top 25 wealth creators increased for Abu Dhabi (4 to 6) and Kuwait (1 to 6), remained the same for Saudi Arabia (10), Qatar (1), and Bahrain (1), and decreased for Dubai (8 to 1) in 2017-21 compared to 2012-16. There has been a shift in wealth creation among sectors from real estate to Materials and Industrial sectors between the period 2012-16 and 2017-21.

Please write to enquiry@e-marmore.com if you need a full deck of slides on this research.

Source: Refinitiv; Marmore Research

The fastest wealth creator in terms of annual growth rate of total return is also Abu Dhabi listed International Holding Company with CAGR of 101% which is more than 10x higher compared to the S&P GCC Composite Index with a CAGR of 10%. The International Holding Company created wealth at a slow pace for the first five years 2012-16 and then it added its wealth enormously with a CAGR of 210% in the last five years 2017-21. The shares have been increasing from 2019, when it was trading at ~AED 1 (its current share price is ~AED 190). The various acquisitions made since the start of 2019 seem to have contributed to the surge in share prices.

If the period is further broken into two five-year periods (2012-16 & 2017-22), major changes are observed in wealth-creating companies and sector performances. The wealth creators of 2012-16 are entirely swapped with a new set of companies in 2017-21. The wealth created in 2017-21 by these companies exceeded three times the wealth created in 2012-16. The number of companies in the top 25 wealth creators increased for Abu Dhabi (4 to 6) and Kuwait (1 to 6), remained the same for Saudi Arabia (10), Qatar (1), and Bahrain (1), and decreased for Dubai (8 to 1) in 2017-21 compared to 2012-16. There has been a shift in wealth creation among sectors from real estate to Materials and Industrial sectors between the period 2012-16 and 2017-21.

Please write to enquiry@e-marmore.com if you need a full deck of slides on this research.Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More