The consumption of energy in GCC is driven by high level of urbanization, growing expatriates, fuel subsidises and industrialization. The continuous growth in energy consumption is snowballing into a major issue, as GCC countries are finding it difficult to suffice their own needs. According to World Energy Council, Gulf Cooperation Council (GCC) is expected to require 100 GW of additional power in next ten years to suffice their domestic consumption requirements.

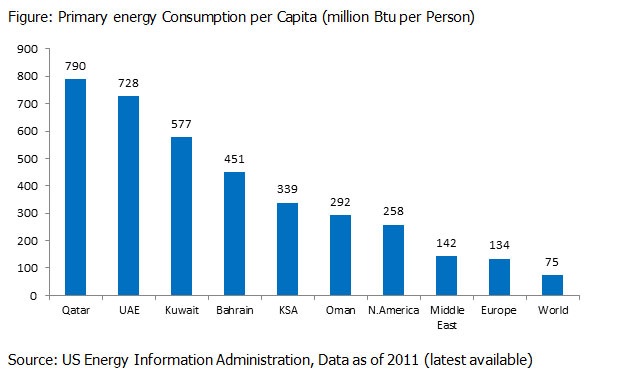

GCC countries per capita power consumption is amongst the highest in the world (see below figure). In a joint policy research by IFRI and Markaz titled “Powering Kuwait into 21st Century: Alternatives for Power Generation” rising population and expansion in housing were cited as the primary reasons for the surge in power consumption. The idea is reinforced by the fact that buildings consume 75% of electricity in Kuwait with 65% being utilized for air conditioning purposes alone.

The Kuwaiti Electricity and Water Ministry estimates that while the power consumption has increased by 8% per annum, power supply has grown only at the rate of 6% per annum and this could lead to demand overshooting supply in the coming years, if measures aren’t taken to boost energy supply. UAE as of now has enough gas to produce 20,000-25,000 MW of electricity but the peak power demand is forecasted to reach 33,400 MW by 2020. Dubai’s power and desalination capacity is set to triple in size by 2015 to reach 16,000 MW and 800 million g/d respectively. Oman uses 19.5 million meter cube of gas to produce power and for desalination per day.

High power consumption apart, water consumption on a per capita basis is also high among GCC countries. To make thing worse the region has scarce water resources – no permanent lakes or rivers, limited groundwater reservoirs; receives scanty rainfall and population has grown faster than the world average. GCC is one of the largest consumers of desalinated water globally with about 99% of the water consumed being produced through desalination, an energy intensive effort working primarily on gas feeds. Demand for water is growing at an accelerated pace, similar to that of power and artificially low tariffs fuelled by subsidies have led to indiscriminate use and subsequent wastage. UAE is one of the world’s largest consumers of water with average per capita consumption at 550 litres per day against World average of 230 litres.

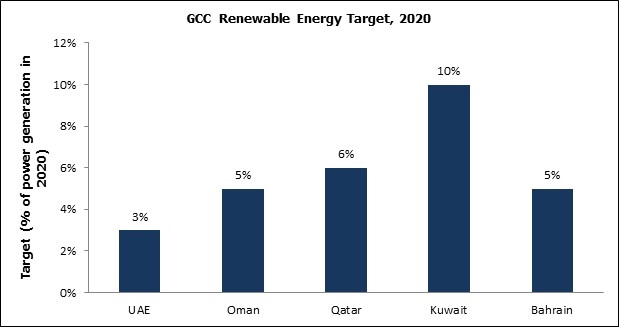

There could be at least USD 100 billion investment in power sector to add up 36 GW of generation capacity by the respective countries. Despite this, the huge demand cannot be satisfied through conventional energy sources alone. While, diesel can be used for peak loads it is not a sustainable option for the long run. Hence, GCC countries are taking active measures towards developing their renewable energy sources. As a first step, towards adoption of renewable energy, it has set itself a target for renewable energy in 2020.

Embracing renewable energy will reap many benefits for GCC region. Realization of the declared renewable energy target can potentially lead to significant job creation across the renewable energy value chain including manufacturing, installation, operation, maintenance and R&D. In order to achieve this there is a need to facilitate renewable energy education and training. Renewable energy can save mammoth of reserves of oil and gas which GCC keeps burning at subsidized rate for power generation. These fuels can rather be used for exporting.

Source: Frost & Sullivan analysis of stated targets and plans by GCC countries

Despite the potential, barriers exist that prevent adoption of renewable energy in a big way in GCC. Availability of fossil fuels at highly subsidised rates and lack of renewable friendly regulations are chief amongst them. Regulators need to create a conducive environment that mitigates the investors risk in renewable energy projects. Policies and regulations that promote renewable energy should not only concentrate on large scale projects; but should also be active in promoting small and medium scale projects, such as installing solar panels and solar water heater in cities.

The threat of high return or low risk in other projects can prove to be an impediment for new investments in renewable energy projects. The other key challenge is the ability to integrate this source of energy effectively with the existing transmission and distribution network in an effective and stable manner.

They are certain environmental concerns which arise from the generation of electricity and desalination. Electricity which is energy intensive results in release of pollutants air emissions. Desalination also causes potential environmental impact such as Green House Gas (GHG) Emission due to energy demand of fossil fuels, release of concentrated and chemical discharges which destroys costal water quality and affects marine life. Rejected Brine is discharged as waste water in last stage of desalination and it is highly concentrated. It discharged to the sea changes the salinity, alkalinity and temperature average of sea and it affects the marine life.

GCC countries have abundant thermal heat which could be harvested for use in desalination and electricity generation, through solar concentrating technology and photovoltaic technology, whilst wind energy can be tapped in coastal and islands communities. Only with renewable energy both GHG emission and fossil fuel energy use can potentially be reduced.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read More