KSA Residential Real Estate - Transactions Review (Q3 2015)

Marmore Team

30 November 2015

Due to this, strong supply is expected from projects undertaken by the local government agencies. According to Marmore’s report on KSA Residential Real Estate, The Ministry of Housing is developing 15,000 units (handover in 2017) and 15,500 more units being planned. The Ministry of Housing is developing its first project in Riyadh, which includes 675 apartments and 2,200 land plots, which is expected to increase the supply of affordable housing, as a large proportion of the population still does not own a house in KSA. But, demand for residential real estate is expected to be relatively low due to the new mortgage policy, which has reduced the amount of loan permitted on a property. Increasing land prices, lack of construction finance and availability of land, constrain supply especially in affordable housing and middle-income housing segments. As a result a significant percentage of middle-income households choose to rent rather than purchase property. On the other hand, rising income levels and changing lifestyles has led to increase in supply of luxury high-rise residential units, with greater focus on “modern luxury”. But the combination of low interest rates and continued fiscal stimulus has raised concerns of potential asset bubbles, especially in the property markets, with the bank lending to real estate increasing by 31 per cent in 2014.

Value of construction contracts awarded in the first half of 2015 stood at USD 37bn, and despite lower oil price the contracts were awarded at a faster pace in 2015, compared to 2014. Residential real estate, roads, power and healthcare were the primary sectors accounting for close to two-thirds of the total awarded contracts, while Riyadh region captured the lion’s share of awarded contracts. Construction activity also seems to have peaked, with the demand for cement rising at double digits over the last five years.

Real Estate Transactions

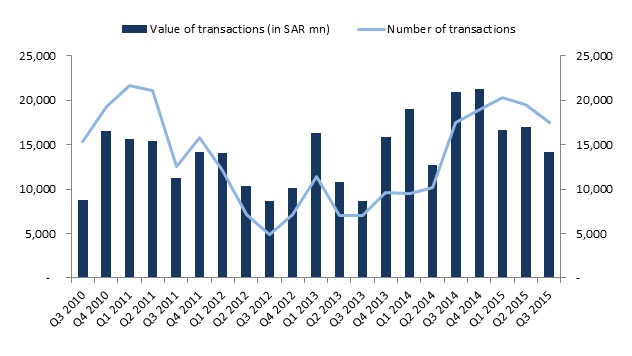

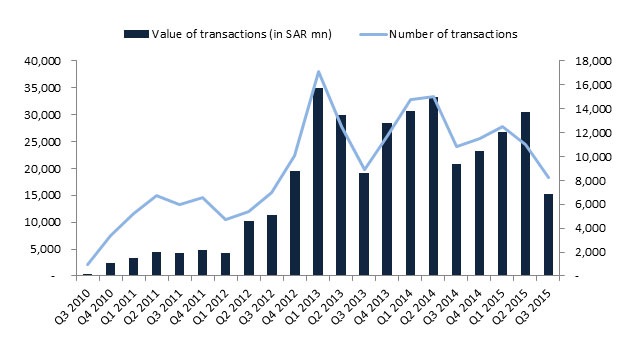

The number of transactions continued to decline due to the new mortgage law, which limits the maximum loan amount to 70 per cent of the property value. Average price per sq m experienced quarterly decline in all three major cities; average price per sqm for land in Riyadh declined 27 per cent YoY, followed by decline of 25 per cent in Jeddah.

These declines accompany a decline in total number of transactions indicating that the sharp drop in recorded prices is not sustainable and are set to adjust after the bottleneck clears, which can only be fueled by liquidity, in the form of credit availability, and a rise in affordability. Only then will the market adjust to fair and long term sustainable values with less volatility.

Figure: Number and value of residential real estate transactions in Riyadh from July 2010 to 2015-YTD

Source: Ministry of Justice, Marmore Research

Figure: Number and value of residential real estate transactions in Makkah (Jeddah) from July 2010 to 2015-YTD

Source: Ministry of Justice, Marmore Research

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

Kuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreHow secure are GCC banks compared to their global counterparts?

The blog examines the impact of cyber attacks on financial institutions and the resiliency of GCC banks compared to their global counterparts

Read More