Public expenditure on Education in Saudi Arabia is expected to hover around c.7% of nominal GDP in near future. Based on our estimates, the total market-size of KSA education market by spending is estimated at USD 66.66Bn in 2014.

The formal education system in Saudi Arabia is similar to overall GCC education structure and can be divided into three broad levels: primary, secondary and tertiary. Noticeably, pre-primary education in Saudi Arabia is not a part of formal education structure unlike some of its GCC peers. According to Marmore’s KSA Education report, primary and Secondary education together lasts for 12 years and Tertiary Education can last upto 9 years. Educational institutions in KSA can be public or private. Private Schools can be divided based on types of curriculum (Arabic, Bilingual, Asian or Western Schools).

The demand for private schools have increased in Saudi Arabia due to better quality of education and also due to a law passed in 2009 which allowed Saudi nationals to be enrolled in international schools. The country has also witnessed significant growth in private universities during the past decade.

Since pre-primary level of education is not a part of formal education structure, the gross enrollments ratio (GER) (13.2%, 2012) at this level of education in KSA is very low when compared with other GCC countries and some of the developed and developing countries. According to Marmore’s KSA Education report, the GER (Gross Enrolment Rate) at the primary level in KSA (102.77%, 2012) and GER at secondary level (114.27%, 2012) is comparable to other countries. The GER at tertiary level in KSA (50.94%, 2012) is highest within GCC, however still much less than some of the developed countries. KSA has still has a long way to develop their tertiary education system to help their young population equip with the right set of skills and expertise to meet the job markets demand, instead of being dependent upon importing expatriate skilled labor force.

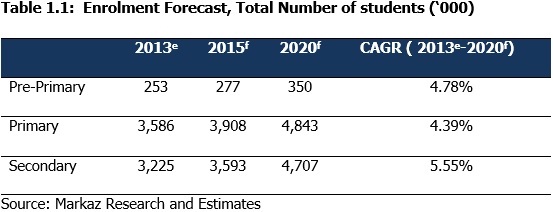

Our enrolment forecast for various levels of education is as follows:

KSA education sector is poised to grow aided by its’ growing population and relatively high proportion of young age population. Increasing government support to the sector and increasing income level of Saudi population will also play positive for the sector. High level of unemployment among Saudi nationals, mainly due to disconnect between their skill sets and market needs, will further drive demand for better quality education.

Growing size of the education market in KSA will provide ample opportunities for private players at all levels. More specifically opportunities in higher education market are vast. Private players will get benefitted from government support to private sector and growing preference for private educational institutes.

However, Saudi education sector also faces a number of challenges. Gross enrolment rates at pre-primary and tertiary levels are low. The quality of programs and curricula designed for public institutions in KSA is not considered of high standards. The sector faces a challenge to due to increasing cost of establishing and operating an educational institute. Fast reforms are required to improve the quality of education as well as to increase the supply of educational institutions to match the growing demand.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read MoreTags

No Tags!